Institutional Insights: Deutsche Bank Investor Flows & Positioning 26/1/26

Inflows To Cyclicals Surge

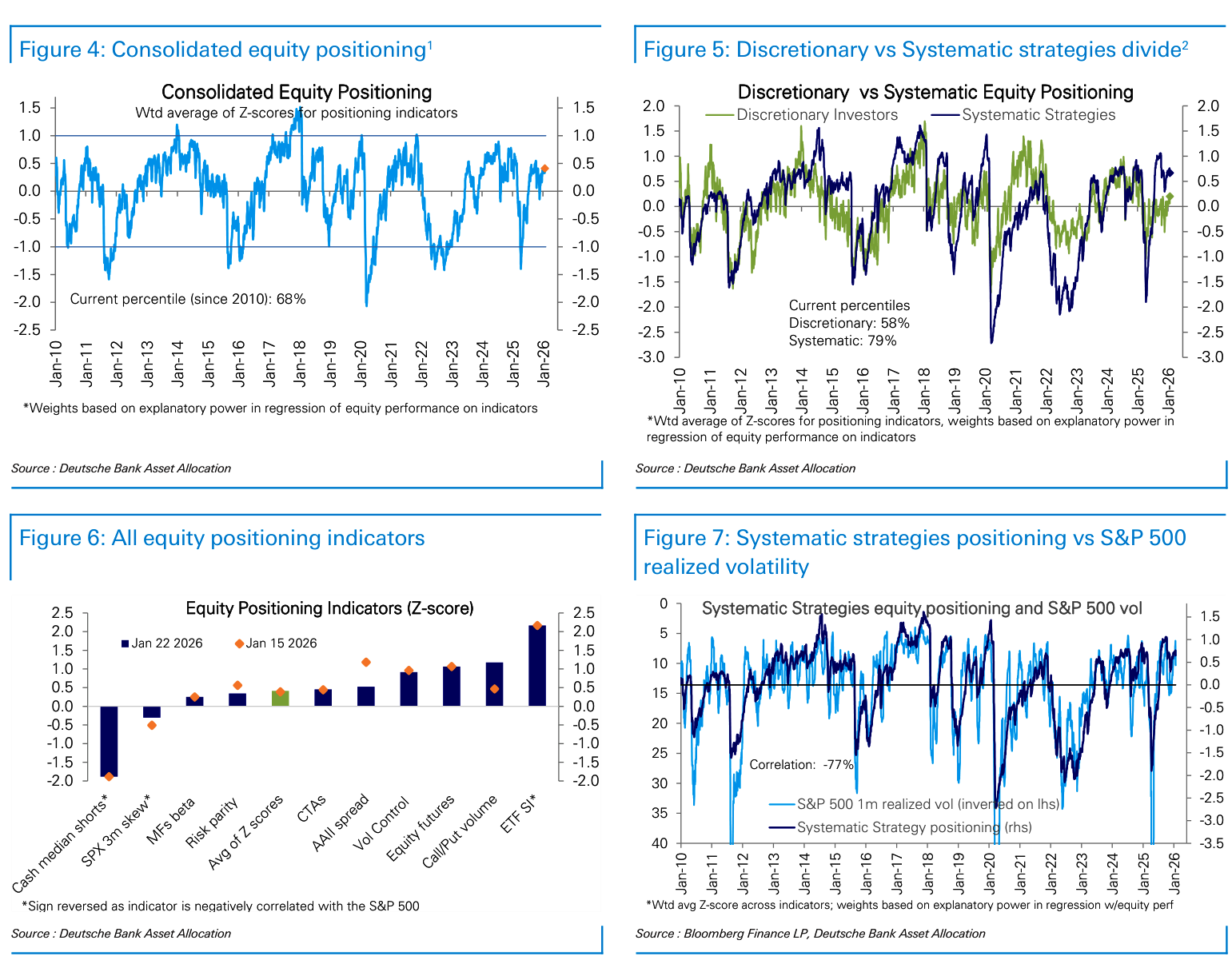

Equity positioning remains largely unchanged at the headline level, mirroring the S&P 500’s sideways movement despite several brief market disruptions (0.41 standard deviations, 68th percentile). Systematic strategies reduced their overweight exposure this week as volatility increased (0.67 standard deviations, 79th percentile).

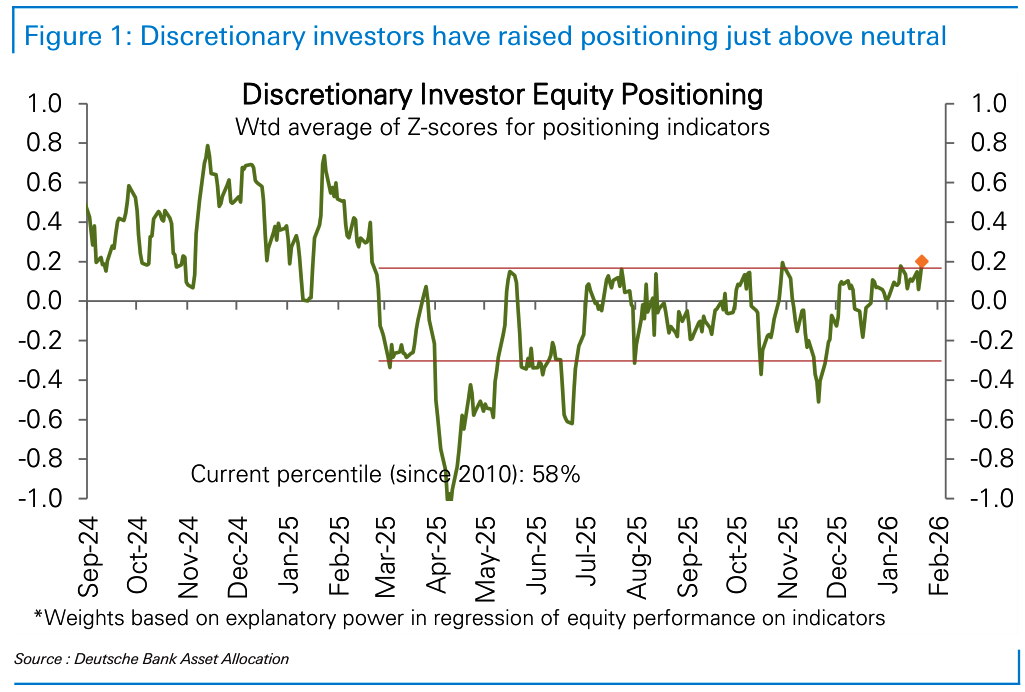

Discretionary investors have slightly increased their positioning to just above neutral, maintaining a cautious stance that has persisted since March (0.20 standard deviations, 58th percentile). These investors continue to rotate out of mega-cap growth and Technology stocks, reducing their previous overweight positions to neutral, and shifting into cyclical sectors, moving from an underweight stance to a slight overweight. This trend aligns with ongoing sentiment improvements, subdued overall positioning, and continued sector rotations, as noted in recent reports (Rising Sentiment, Subdued Positioning, Continuing Rotations, Jan 9, 2026; Sector Positioning Converging Toward Neutral, Jan 16, 2026).

Cyclical sector funds experienced a significant surge in inflows this week. Materials saw record-breaking inflows of $6.5 billion, surpassing last week’s high. Industrials ($3.0 billion), Financials ($2.9 billion), and Energy ($1.7 billion) also saw robust inflows. Conversely, Technology funds experienced outflows of $1.4 billion, marking their sixth outflow in the past eight weeks—a stark contrast to the strong inflows observed from July to November. Consumer Goods funds (-$0.9 billion) continued to underperform. Defensive and bond-like sectors remained relatively flat, with the exception of Healthcare, which received $1.3 billion in inflows.

The sustainability of this rotation remains uncertain. Previous bursts of cyclical positioning and inflows, such as those following the 2024 elections, have often lost momentum. The current rotation began two months ago in mid-November, driven by clear signs of broader earnings growth during the Q3 earnings season (Q3 Earnings Takes: Stronger and Broader, Nov 4, 2025). For this trend to persist, a continued broadening of earnings growth—consistent with our forecast—will be critical (Q4 Earnings Preview: Stronger and Broader Again, Jan 6, 2026).

Positioning and Flows Overview

Aggregate Equity Positioning

- Our measure of aggregate equity positioning remains modestly overweight (0.41 standard deviations, 68th percentile).

- Discretionary investor positioning is slightly overweight, nearing the upper end of the cautious range observed over the past 10 months (0.20 standard deviations, 58th percentile).

- Systematic strategies positioning was slightly reduced but stays overweight (0.67 standard deviations, 79th percentile).

Discretionary Investor Positioning

- The call-to-put volume ratio (5-day moving average) surged sharply this week (89th percentile). This increase in net call volume was primarily driven by single-stock options, followed by index options, while ETF options saw a decline.

- Within single-stock options, net call volume rose across most sectors, led by MCG & Tech, while Energy and Consumer Cyclicals remained largely unchanged.

- S&P 500 options skew (3-month, 90%-110%) exhibited choppiness, ending slightly lower than last week.

- A basket of stocks with the highest net call volume last week underperformed the broader market modestly, while a basket of the most shorted stocks slightly outperformed.

- Investor sentiment turned less bullish, reaching its lowest level in four weeks (57th percentile). Bullish responses (73rd percentile) declined, while bearish (60th percentile) and neutral responses (21st percentile) increased.

Systematic Strategies Positioning

- Volatility control funds reduced their equity allocation this week (97th percentile), though their sensitivity to market selloffs remains relatively low.

- CTAs increased overall equity long positioning (83rd percentile), with notable increases across regions: US (63rd percentile), Europe (89th percentile), Emerging Markets (80th percentile), and Japan (54th percentile).

- In the US, long positioning rose for the Russell 2000 (64th percentile) and Nasdaq 100 (53rd percentile) but declined in the S&P 500 (62nd percentile).

- US bond positioning (44th percentile) shifted sharply to net short for the first time since July 2025, while short positioning in European bonds (4th percentile) increased further.

- Short bond positioning in Japan (25th percentile) remained flat, while UK bonds saw a slight increase in long positioning (79th percentile).

- In FX, short positioning in the US dollar grew (33rd percentile).

- In commodities, short oil positioning (7th percentile) increased, while long positioning in gold (60th percentile) and copper (83rd percentile) also rose.

- Risk-parity funds reduced their equity allocation (76th percentile), with declines across the US (68th percentile), other developed markets (71st percentile), and Emerging Markets (81st percentile). Their bond allocation (41st percentile) increased, while allocations to inflation-protected notes (66th percentile) and commodities (75th percentile) remained stable.

Sector Positioning

- Positioning across most sectors is close to neutral.

- Materials (0.29 standard deviations, 76th percentile) remained modestly overweight.

- Real Estate (0.13 standard deviations, 69th percentile) and Healthcare (0.10 standard deviations, 63rd percentile) rose slightly above neutral.

- Utilities (0.08 standard deviations, 58th percentile), Financials (0.07 standard deviations, 53rd percentile), MCG & Tech (0.06 standard deviations, 53rd percentile), Energy (0.05 standard deviations, 68th percentile), Consumer Cyclicals (0.05 standard deviations, 66th percentile), and Industrial Cyclicals (0.01 standard deviations, 65th percentile) hovered just above neutral.

- Consumer Staples (-0.77 standard deviations, 9th percentile) remained significantly underweight.

- Small caps (0.26 standard deviations, 63rd percentile) were modestly overweight and moved sideways this week

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!