SP500 LDN TRADING UPDATE 26/1/26

SP500 LDN TRADING UPDATE 26/1/26

***QUOTING ES1 CONTRACT FOR CASH US500 EQUIVALENT LEVELS SUBTRACT POINTS DIFFERENCE***

***WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN***

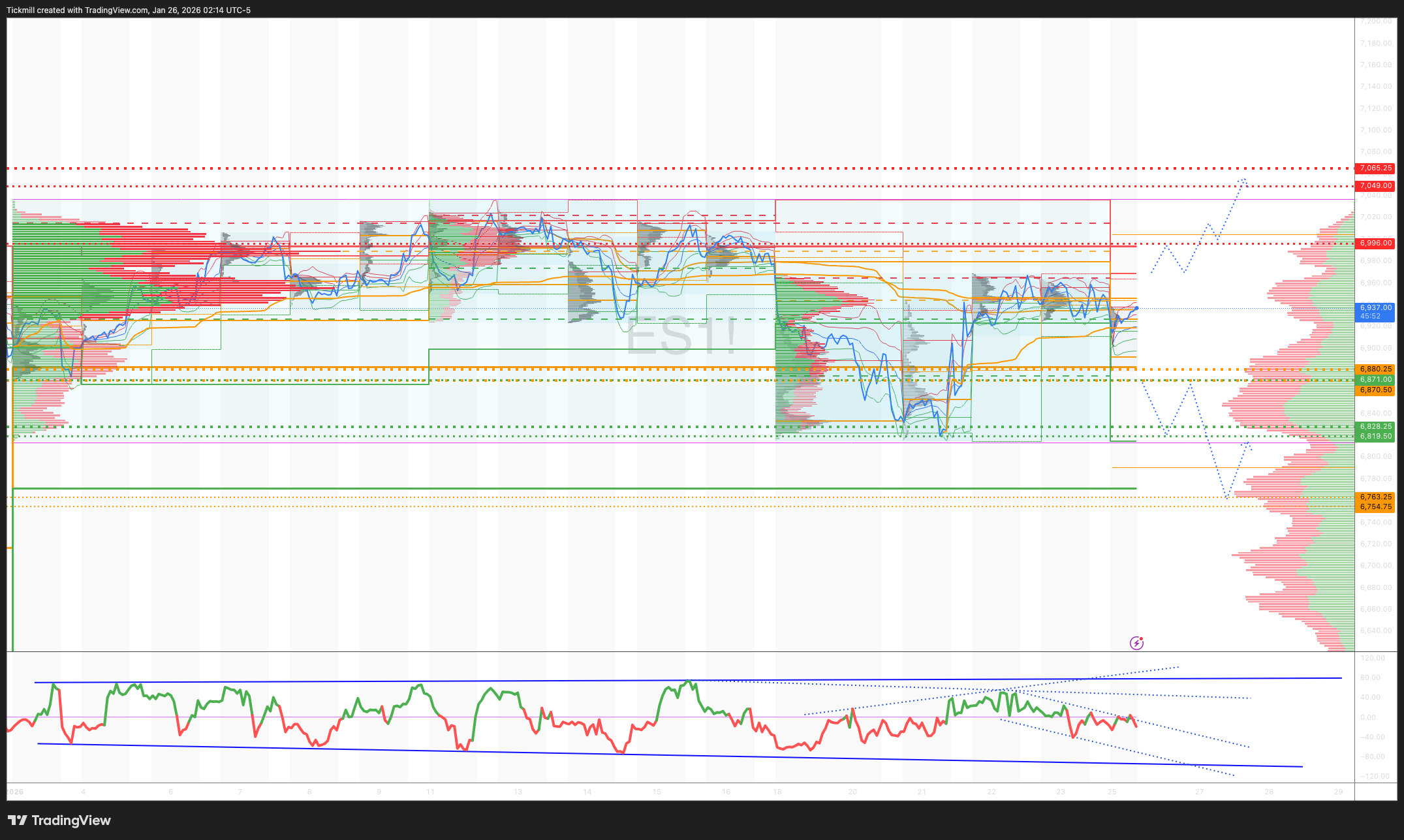

WEEKLY BULL BEAR ZONE 6880/70

WEEKLY RANGE RES 7065 SUP 6928

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

The Gamma Flip Zone at 6972.75 is crucial; above it, the market experiences “Positive Gamma” with reduced volatility and easier upward movement. Below it, “Negative Gamma” results in erratic price action. Bulls must reclaim this level to stabilise the market.

DAILY VWAP BULLISH 6896

WEEKLY VWAP BEARISH 6961

MONTHLY VWAP BULLISH 6856

DAILY STRUCTURE – BALANCE - 6925/6969

WEEKLY STRUCTURE – ONE TIME FRAMING LOWER - 6969

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favouring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

One-Time Framing Higher (OTFH): This represents a market trend where each successive bar forms a higher low, signalling a strong and consistent upward movement.

One-Time Framing Lower (OTFD): This describes a market trend where each successive bar forms a lower high, indicating a pronounced and steady downward movement.

GOLDMAN SACHS TRADING DESK VIEWS

The week ahead from the Futures Desk ( week of the 26th of January)

### Market Recap and Insights:

Last week commenced with a risk-off sentiment, initially fueled by renewed tariff threats, the possibility of U.S.–European retaliation tied to the Greenland dispute, and a weak JGB auction. However, a significant risk-on shift occurred when President Trump and NATO Secretary-General Mark Rutte reached an agreement.

The market narrative quickly transitioned from concerns over a potential sovereign crisis—highlighted by reports such as a Danish pension fund allegedly selling approximately $100 million in U.S. Treasuries—to a notable tightening in OAT/Bund spreads. One portfolio manager pointed out the paradox of investors discussing a U.S. sovereign crisis while simultaneously purchasing French OATs.

The OAT/Bund spread narrowed by 10 basis points over the week, now sitting just 8 basis points away from its level during the June 2024 snap election. The OAT invoice spread indicates that substantial futures flows are distorting the spread, with large stop-loss orders likely amplifying these pronounced movements.

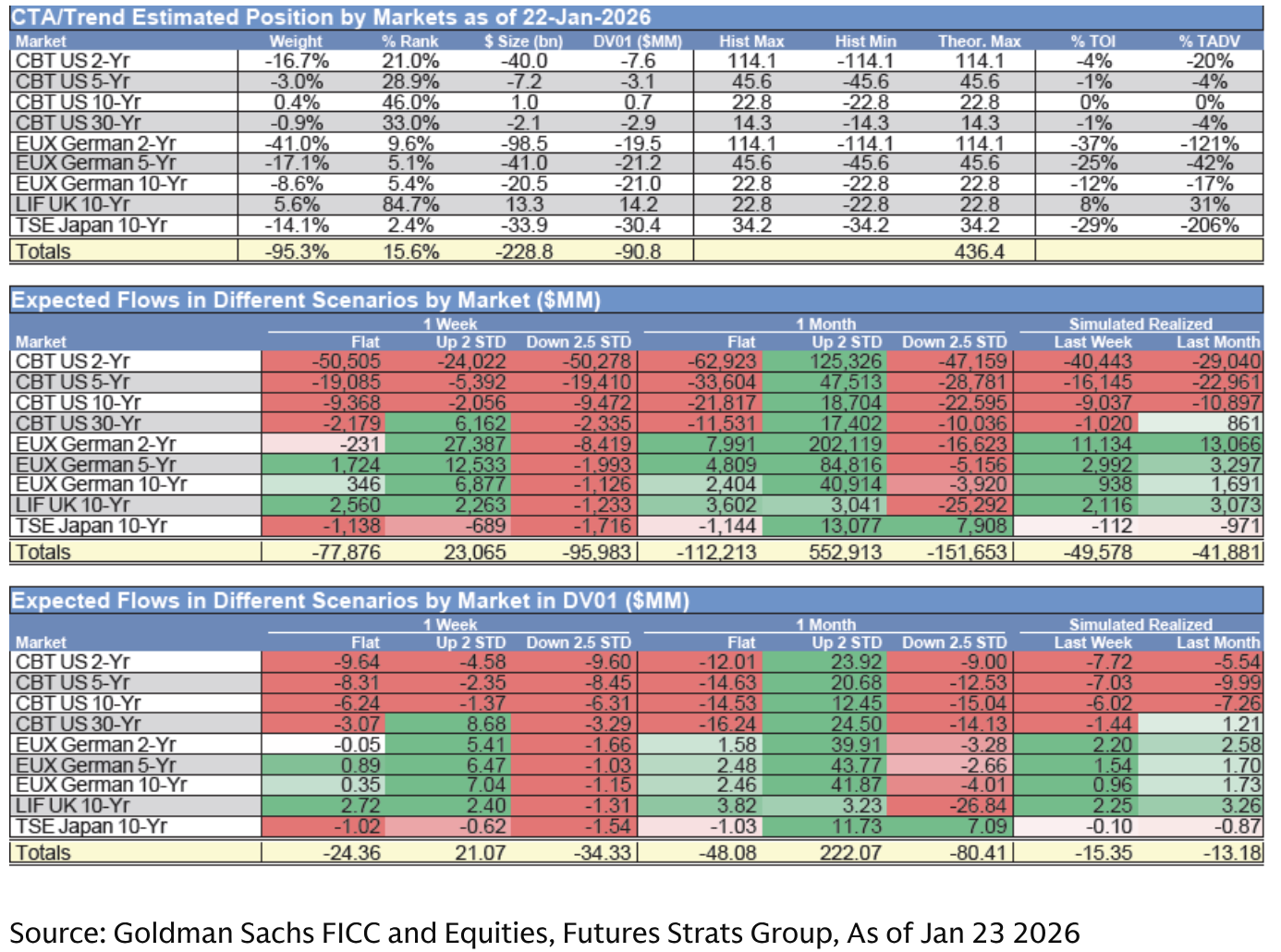

This could present a timely opportunity to counter the recent price action by selling OATs against Bunds. Looking ahead, this week brings net supply in the EU (including potential syndications), in the U.S., and the usual month-end dynamics. Our CTA model suggests that short positions in European duration have begun to ease slightly, while in U.S. duration, CTAs are expected to be net sellers this week across the 2-year, 5-year, and 10-year sectors under flat, rising, or falling rate scenarios.

25 January 2026

Johann Cohen

Goldman Sachs Bank Europe SE, Paris Branch

Global Banking & Markets

Here are the main events from the week ahead:

Jan 26th: German IFO Business Climate, ECB speakers: Nagel and Kocher, European supply, US

durable goods, US 2y auction

Jan 27th: BoJ minutes, ECB speakers: Lagarde and Nagel, European and UK supply, US consumer

confidence, US 5y auction

Jan 28th: German consumer confidence, ECB speakers: Elderson and Schnabel, European supply,

FOMC, BoC rate decision

Jan 29th : ECB speaker Cipollone, European supply, US Jobless Claims, US 7y auction

Jan 30th: German and EUR Unemployment, Spain and German CPI, Eur GDP, ECB Vujcic,

European supply, US PPI and Chicago PMI

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!