REAL TIME NEWS

Loading...

Title GBPUSD H4 | Potential bearish continuation Type Bearish reversal Preference The price is rising towards the pivot at 1.3483, an overlap resistance that aligns with the 61.8% Fibonacci retracement. A reversal from this level could lead the price toward the 1st...

Title GBPUSD H4 | Potential bearish continuation Type Bearish reversal Preference The price is rising towards the pivot at 1.3483, an overlap resistan

Title XAUUSD H4 | Bullish continuation setup Type Bullish bouncePreference The price is falling towards the pivot at 5,223.19, a pullback support that is slightly above the 38.2% Fibonacci retracement. A bounce from this level could lead the price toward the 1st re...

Title XAUUSD H4 | Bullish continuation setup Type Bullish bouncePreference The price is falling towards the pivot at 5,223.19, a pullback support that

Title CHFJPY H1 | Bearish reversal off pullback resistance Type Bearish reversal Preference The price is rising towards the pivot at 202.49, which is a pullback resistance that aligns with the 38.2% Fibonacci retracement. A reversal from this level could lead the p...

Title CHFJPY H1 | Bearish reversal off pullback resistance Type Bearish reversal Preference The price is rising towards the pivot at 202.49, which is

Title EURUSD H4 | Could we see a bounce from here? Type Bullish bounce Preference The price is reacting off the pivot at 1.1691, an overlap support. A bounce at this level could lead the price toward the 1st resistance at 1.1779, a pullback resistance. Alternative ...

Title EURUSD H4 | Could we see a bounce from here? Type Bullish bounce Preference The price is reacting off the pivot at 1.1691, an overlap support. A

Title USDCAD H4 | Bearish reversal off pullback resistance Type Bearish reversal Preference The price is rising towards the pivot at 1.3663, a pullback resistance that aligns with the 38.2% Fibonacci retracement. A reversal from this level could lead the price towa...

Title USDCAD H4 | Bearish reversal off pullback resistance Type Bearish reversal Preference The price is rising towards the pivot at 1.3663, a pullbac

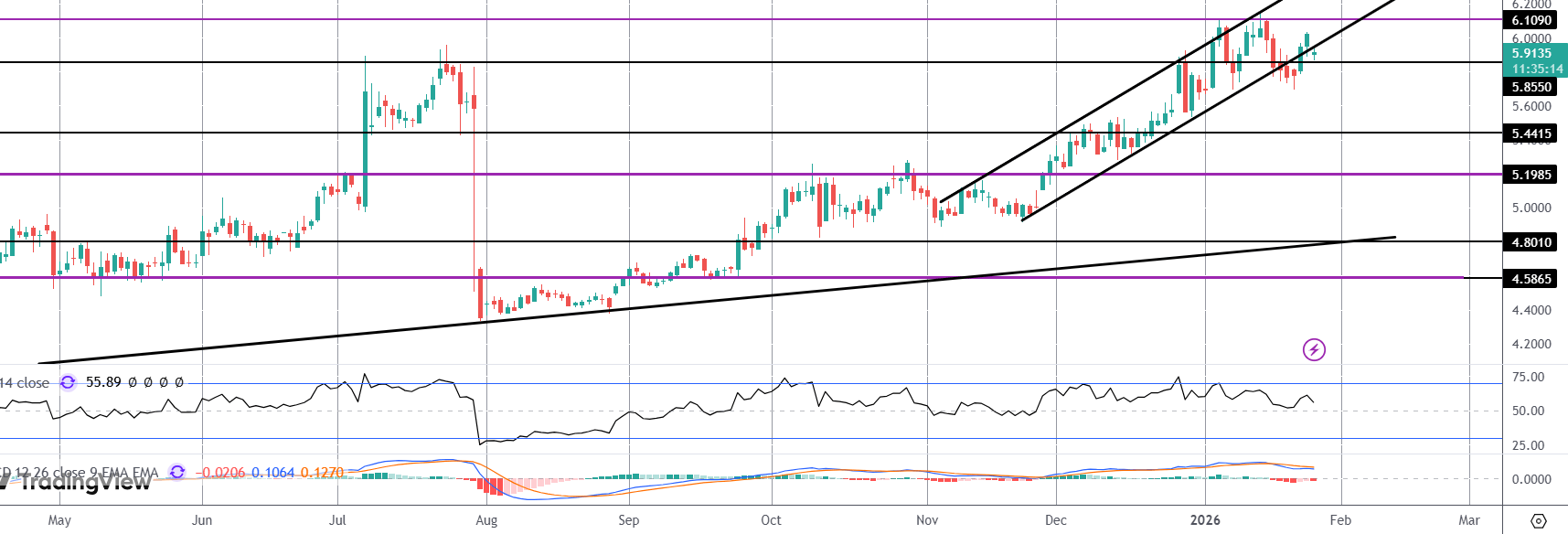

Title XAGUSD H4 | Bullish momentum to extend Type Bullish bouncePreference The price could fall towards the pivot at 90.42, a pullback support. A bounce from this level could lead the price toward the 1st resistance level at 103.58, a pullback resistance that is sl...

Title XAGUSD H4 | Bullish momentum to extend Type Bullish bouncePreference The price could fall towards the pivot at 90.42, a pullback support. A boun

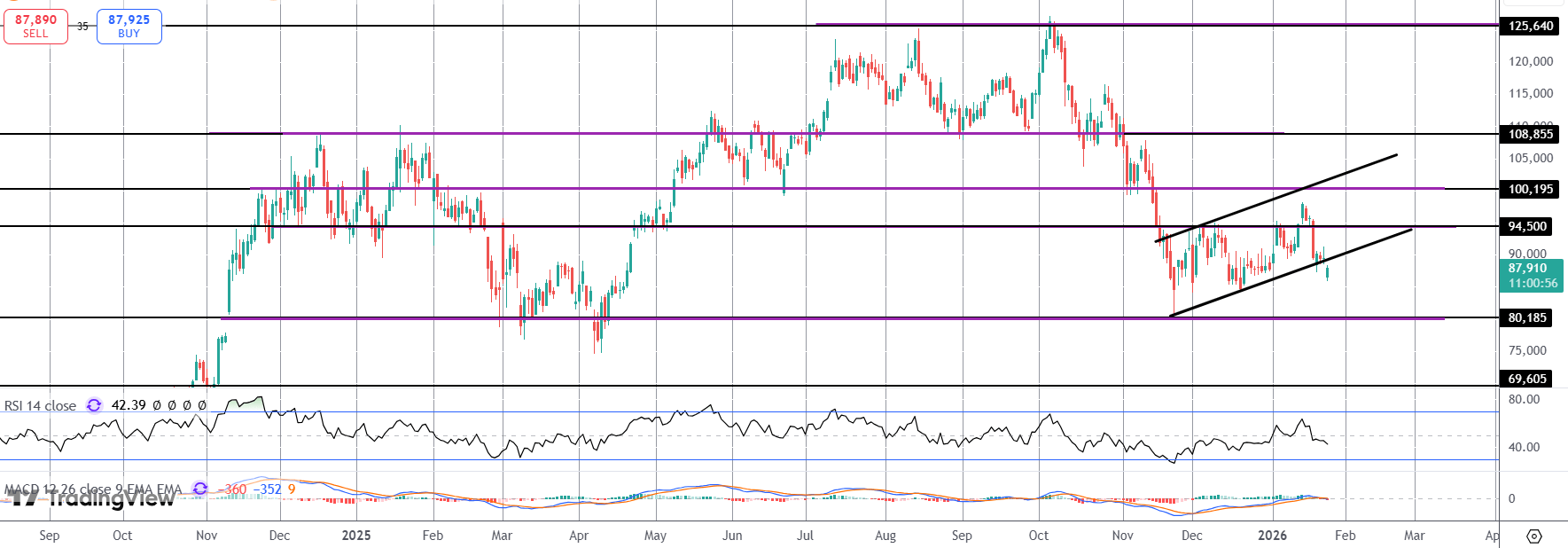

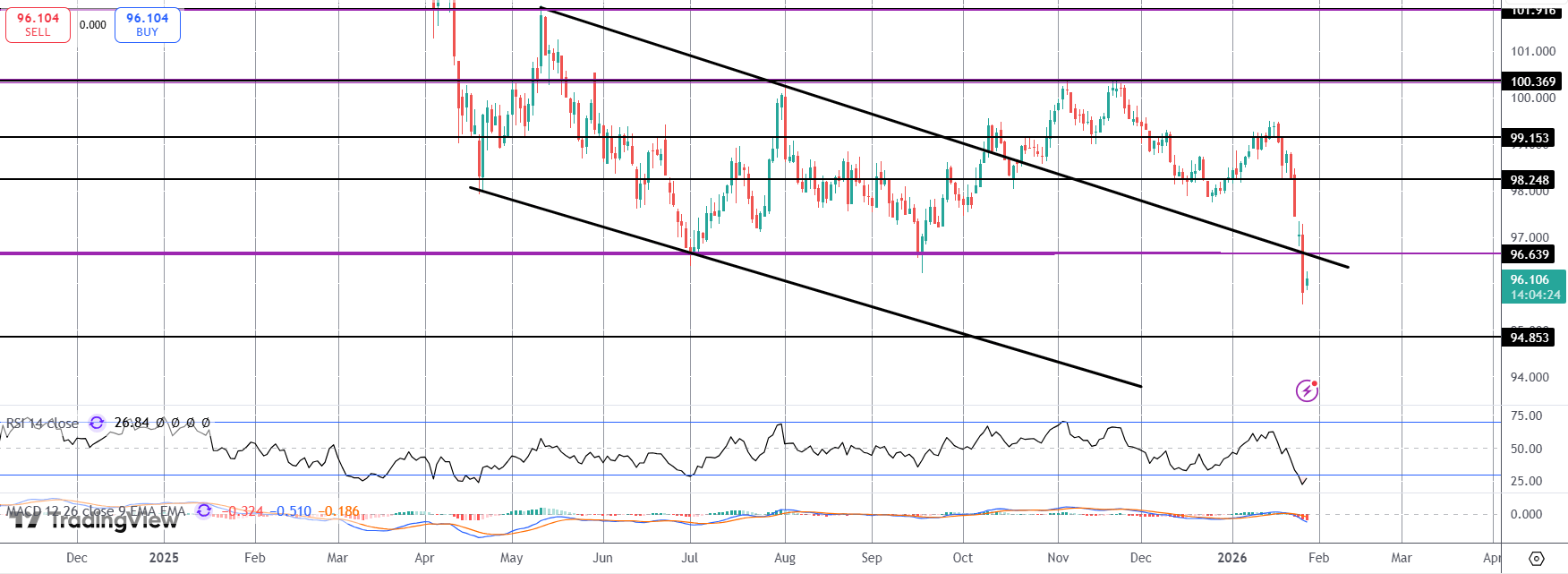

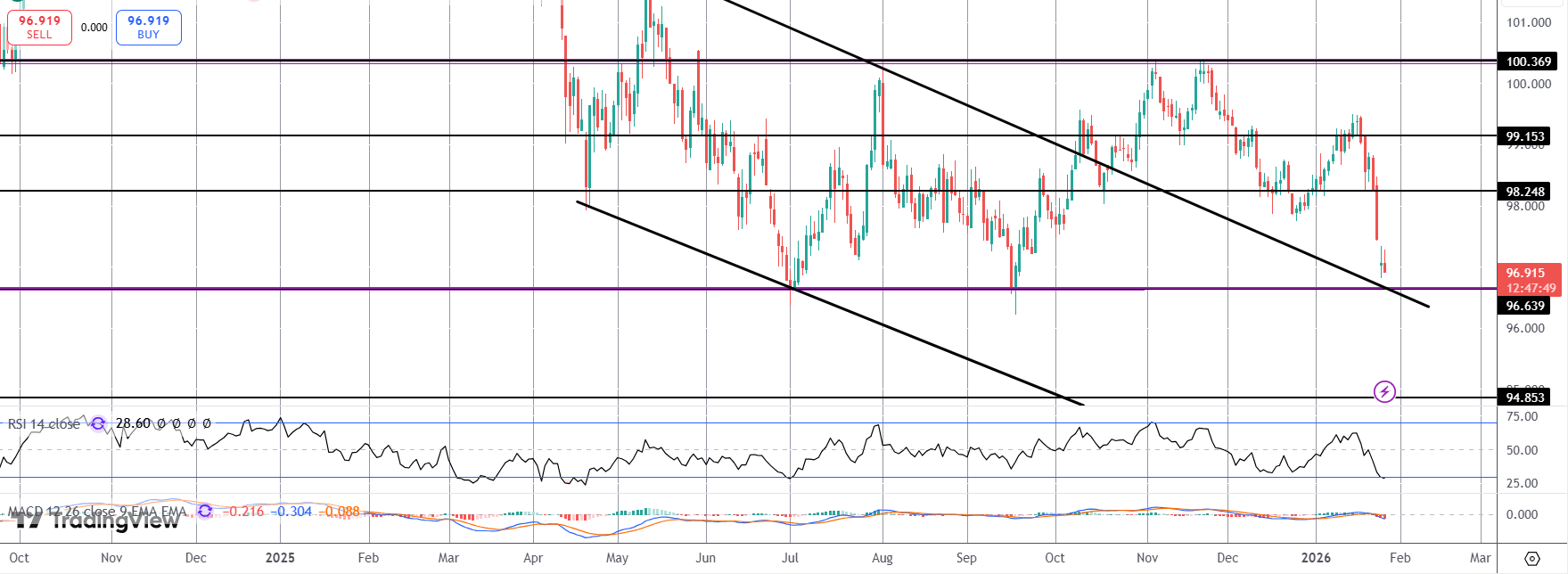

VWAP Swing Strategy Daily Update 02/03/26A daily review of the VWAP Swing Strategy setups -https://www.tradingview.com/chart/XTIUSD/axpUSQP7-VWAP-Swing-Strategy-Daily-Update-02-03-26/...

VWAP Swing Strategy Daily Update 02/03/26A daily review of the VWAP Swing Strategy setups -https://www.tradingview.com/chart/XTIUSD/axpUSQP7-VWAP-Swin

Title AUDNZD H4 | Bullish continuation setupType Bullish bounce Preference The price is falling towards the pivot at 1.18282, a pullback support that is slightly above the 38.2% Fibonacci retracement. A bounce at this level could lead the price toward the 1st resis...

Title AUDNZD H4 | Bullish continuation setupType Bullish bounce Preference The price is falling towards the pivot at 1.18282, a pullback support that

US/Israel Attack IranOil prices are seeing significant volatility at the start of the week following news over the weekend of the US and Israel attacking Iran. Joint missile strikes on Iran led to the killing of the Iranian Supreme Leader, provoking retaliatory att...

US/Israel Attack IranOil prices are seeing significant volatility at the start of the week following news over the weekend of the US and Israel attack

Pound Under PressureThe British Pound is coming under heavy selling pressure today with GBPUSD hitting fresh 1-month lows. Part of the move lower is in response to a stronger US-Dollar which has risen on safe-haven demand following news over the weekend of joint US...

Pound Under PressureThe British Pound is coming under heavy selling pressure today with GBPUSD hitting fresh 1-month lows. Part of the move lower is i

.png)