What's Driving Today's Bitcoin Crash?

Bitcoin Plunges

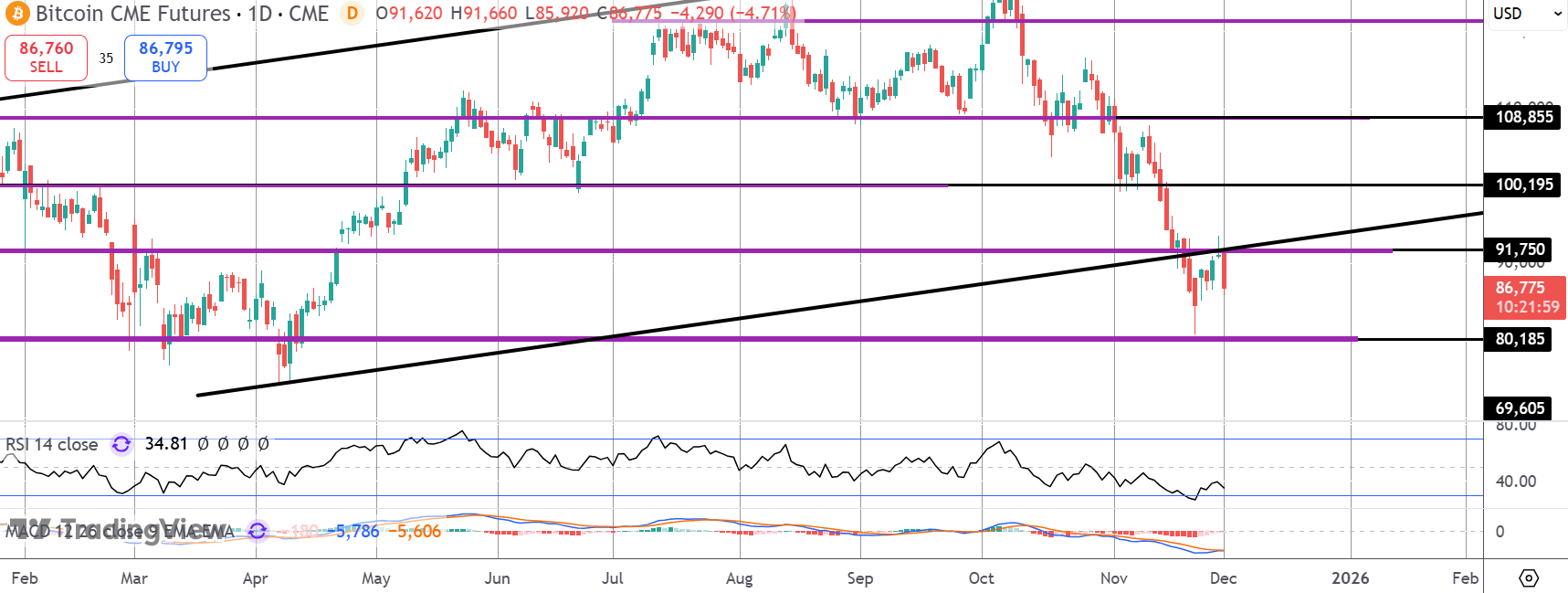

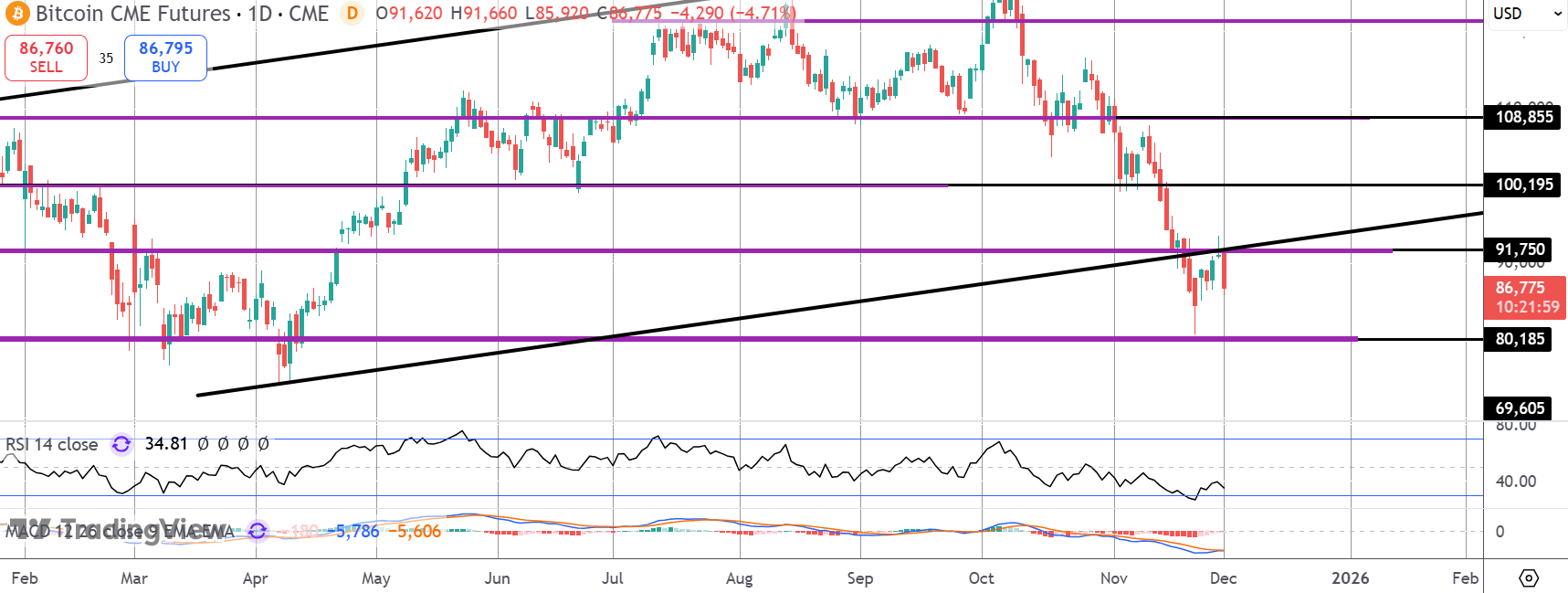

Bitcoin is on watch this week as the futures market reverses heavily lower on Monday. Following an attempt at breaking back into the bull channel last week, price was firmly rejected at the $91,750 level and has since fallen around 5% lower. The move comes despite fresh weakness in USD and a generally supportive backdrop with traders now once again pricing in a December cut from Fed. BTC plunged lower through October as dovish Fed expectation evaporated in line with firmer inflation data and the subsequent US govt shutdown. However, despite the revival in dovish expectations, BTC has failed to recover and now looks at risk of a fresh plunge lower.

Liquidity Issue or Macro-Driven?

There is some interesting commentary this morning from BRN (a crypto technology bridge company) that notes the late cycle fragility of Bitcoin. BRN points to the current decline being part of a liquidity issue rather than a change in sentiment. BRN head of research Timothy Misir notes that a slowdown in whale purchases and an accompanying spike in retail buying ahs led to a fragile liquidity environment leading to positioning washouts as we saw today. However, a research note from QCP Capital points to hawkish comments from BOJ governor overnight which spooked investors and sparked the sell off, along with weakness in Chinese services PMI data which fell for the first time in almost 3 years. Looking ahead, the focus now is on whether BTC can hold the November lows, opening the chance for a recovery higher or if we are going to see a fresh breakdown.

Technical Views

BTC

The correction higher in BCT has failed into a retest of the broken bull channel lows and the $91,750 level. Price is now turning lower again and with momentum studies bearish, focus is on a fresh test of November lows and the $80,195 level with the YTD lows the next bear target below that level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.