SP500 LDN TRADING UPDATE 4/12/25

SP500 LDN TRADING UPDATE 4/12/25

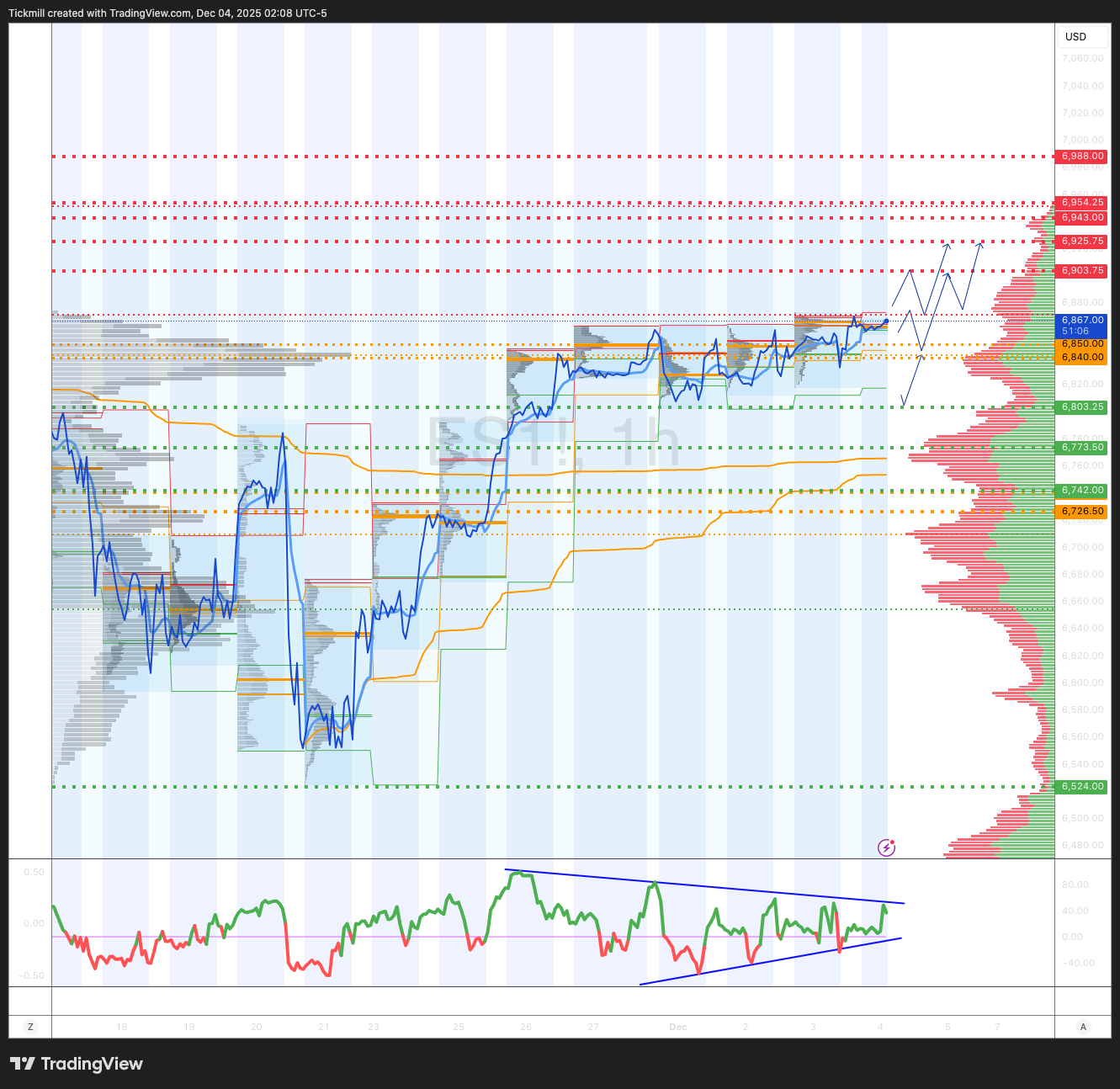

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6740/26

WEEKLY RANGE RES 6943 SUP 6773

DEC EOM STRADDLE 6631/7067

DEC QOPEX STRADDLE 7025/6303

WEEKLY VWAP BULLISH 6726

MONTHLY VWAP BULLISH 6758

WEEKLY STRUCTURE – BALANCE - 6892/6539

MONTHLY STRUCTURE – BALANCE - 6952/6539

The SPX aggregate gamma flip point is at 6720, whereas we're currently close to the relative peak around 6850. This indicates that dealers typically support the price and will act to stabilise it as it fluctuates upward and downward.

DAILY STRUCTURE – ONE TIME FRAMING HIGHER - 6820

DAILY VWAP BULLISH 6843

DAILY BULL BEAR ZONE 6740/50

DAILY RANGE RES 6925 SUP 6803

2 SIGMA RES 6988 SUP 6742

VIX BULL BEAR ZONE 22.2

PUT/CALL RATIO 1.22 ↑

TRADES & TARGETS

LONG ON ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW

EQUITIES COLOUR - UNWINDY

S&P closed +30bps at 6,850 with a $2bn MOC to SELL. NDX gained +20bps to 25,607, R2K surged +191bps to 2,512, and Dow rose +86bps to 47,883. Trading volume reached 15.6b shares across all US equity exchanges versus the YTD daily average of 17.47b shares. VIX dropped -3.01% to 16.08, WTI Crude increased +80bps to $59.11, US 10YR yield fell -3bps to 4.06%, gold edged higher +8bps to 4,209, DXY declined -46bps to 98.90, and Bitcoin jumped +170bps to $93,190k.

Despite overall index gains, underlying market dynamics revealed challenges. Our High Beta Momentum Short basket (GSXULMOM) moved over +2% to the upside, signaling pressure. Healthcare stood out with our most short basket (GSCBMSHC) squeezing +525bps. Retail rebounded strongly after yesterday's pause, driven by footwear strength—ONON rose +4.3%, DECK +3.5%, attributed to DKS's impressive +8.9% gain following positive conference feedback. In tech, AI headlines were mixed: MSFT lagged on reports of reduced AI software sales quotas due to customer resistance (denied by the company), while MRVL outperformed on improved data center guidance and its Celestial AI acquisition.

Looking ahead to tomorrow: Macro events include US initial jobless claims, Brazil GDP and trade data, and Eurozone retail sales. Micro highlights feature investor days for CMCSA, CWK, DNLI, and IMAX, alongside EPS reports: Pre-market DG, DCI, HRL, BF.B; Post-market COO, RBRK, IOT, DOCU, HPE, KR, and ULTA.

Flows: Activity levels were moderate, rated a 4/10. We ended with a slight net buy skew (+110bps), driven by LO net buying, particularly in macro products. Industrials saw net selling, while HFs sold ~$700m net, focused on Macro Products and Financials. Conversely, HFs were net buyers of Healthcare.

Derivatives: After the morning drop, flows were light as the market recovered into positive territory. Volatility compressed further, supporting potential upside. Dealers remain long gamma at current levels, slightly shorter on selloffs and longer on rallies. NDX vol continues to decline with room to compress further. We favor SPX call spreads into year-end for a bullish outlook—SPX 31Dec 7000/7100 call spread priced at ~$23.25 (ref 6865, 15d). The straddle for the rest of the week closed around ~70bps.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!