SP500 LDN TRADING UPDATE 2/12/25

SP500 LDN TRADING UPDATE 2/12/25

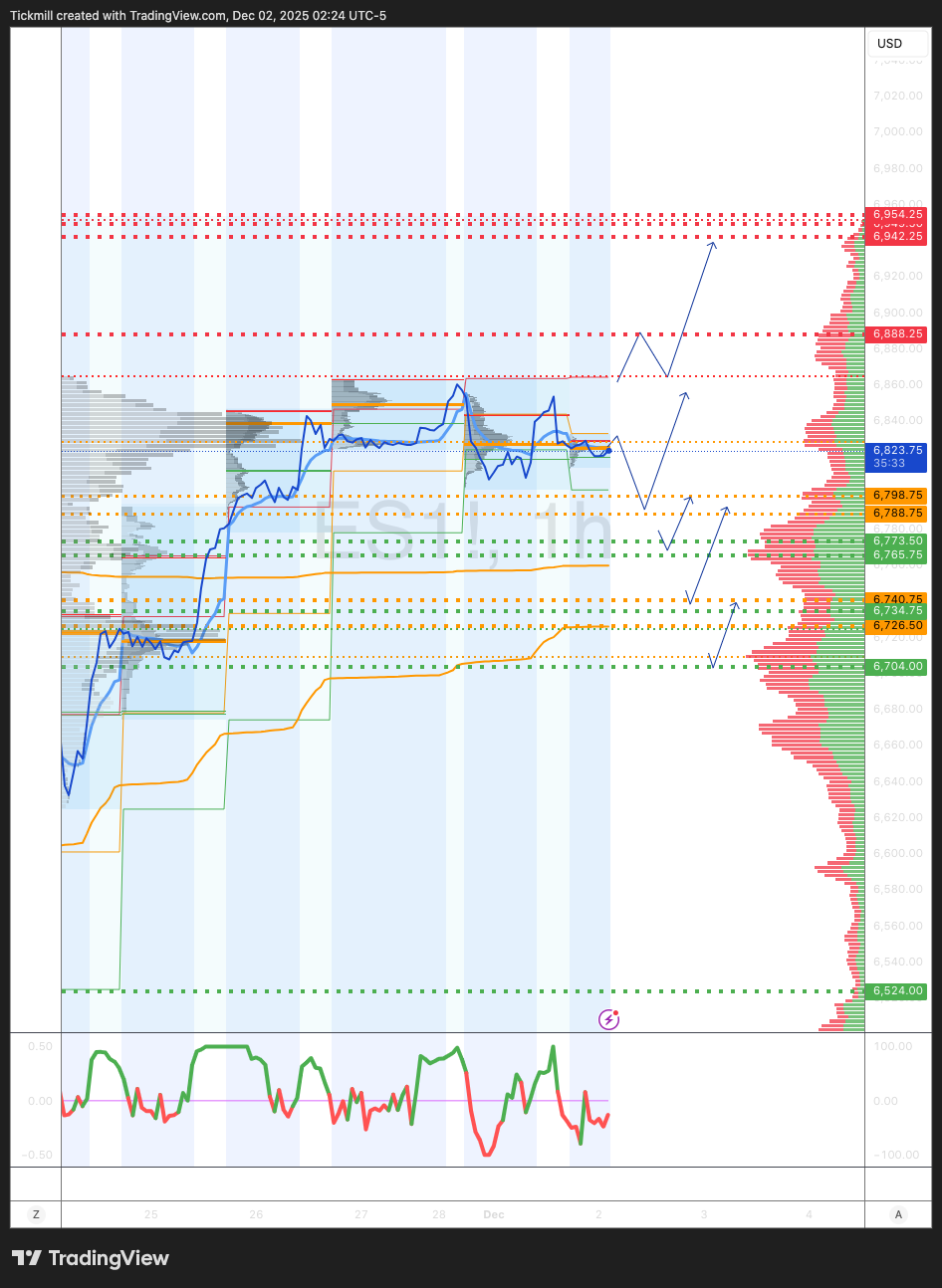

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6740/26

WEEKLY RANGE RES 6943 SUP 6773

DEC EOM STRADDLE 6631/7067

DEC QOPEX STRADDLE 7025/6303

WEEKLY VWAP BULLISH 6726

MONTHLY VWAP BULLISH 6758

WEEKLY STRUCTURE – BALANCE - 6892/6539

MONTHLY STRUCTURE – BALANCE - 6952/6539

The SPX aggregate gamma flip point is at 6720, whereas we're currently close to the relative peak around 6850. This indicates that dealers typically support the price and will act to stabilise it as it fluctuates upward and downward.

DAILY STRUCTURE – BALANCE - 6863/6795

DAILY VWAP BULLISH 6815

DAILY BULL BEAR ZONE 6798/88

DAILY RANGE RES 6888 SUP 6765

2 SIGMA RES 6950 SUP 6704

VIX BULL BEAR ZONE 22.2

TRADES & TARGETS

LONG ON ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

S&P closed down 53bps at 6,813 with a Market-on-Close (MOC) imbalance of $1.5bn to sell. The NDX declined 36bps to 25,343, R2K dropped 125bps to 2,469, and the Dow slid 90bps to 47,289. Trading volume totaled 15.7 billion shares across all U.S. equity exchanges, below the YTD daily average of 17.47 billion shares. The VIX rose 5.38% to 17.23. In commodities, WTI Crude climbed 155bps to $59.46, while gold dipped 1bp to $4,239. The U.S. 10-year yield increased 8bps to 4.09%. The DXY fell 6bps to 99.4, and Bitcoin tumbled 603bps to $85,695.

Markets started the week mostly lower following the U.S. holiday, as indices digested the recent ~5% S&P rally over the past five sessions. Cryptocurrencies notably underperformed, with Bitcoin-sensitive names (GSCBBTC1) down 327bps, 12M Winners (GSXUHMOM) off 389bps, Most Short (GSCBMSAL) down 295bps, and Power Up America (GSX1POW1) lagging by 255bps.

Volumes showed a solid rebound after the holiday lull but remain ~20% below the 20-day average. Top-of-book liquidity also improved from last week. Key dynamics for the week include sustained buyback activity, with volumes running 1.3x the YTD daily average, expected to continue through December 19. CTA selling pressure has eased, providing a positive tailwind into year-end. While December is historically choppier, retail investors have consistently bought dips in the second half of the year, aligning with YTD trends. However, Bitcoin’s >15% decline over the past month has raised concerns.

The Fed is in its blackout period ahead of next week’s December meeting, with the market pricing in a 99% probability of a rate cut. After this cut, expectations are for the FOMC to slow easing in early 2024, potentially pausing in January but delivering two more cuts in March and June, bringing the terminal rate to 3–3.25%. Additionally, Trump’s decision on the next Fed Chair is a key upcoming catalyst. Consensus suggests an announcement within two weeks, with Kevin Hassett being the expected pick—any alternative would be a surprise.

Flows: Activity levels on the floor were moderate, rated a 3 out of 10. The day ended with a -179bps sell skew, driven primarily by hedge funds (HFs), which were -8% net sellers, contributing close to $1bn in supply. Macro products and tech led the selling, with HFs net selling every sector except staples. Healthcare saw the most consistent HF demand. Long-only (LO) investors were small net buyers, favoring tech, while ETFs saw concentrated selling. Fundamental long/short HF gross exposure remains elevated at 212%, ranking in the 100th percentile over 1-, 3-, and 5-year lookbacks. Squeeze risk persists, with net exposure at 58%, ranking in the 89th, 96th, and 72nd percentiles over the same periods.

Derivatives: Activity in the vol space was muted as December began. Despite the small selloff, flows were tilted towards hedging. The Thanksgiving rally helped alleviate CTA selling pressure, while the retracement in medium-term volatility allowed systematic players to add modest length in U.S. equities. Client sentiment has turned more bullish, with the Vol Panic Index hitting 4 on Friday, its lowest level since September. Tomorrow’s straddle closed at 0.53%, with another ~50bps expected as dealers sit in a long gamma range between 6,800 and 6,900. The desk favors buying SPX/QQQ call spreads into year-end to position for a cost-effective rally.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!