SP500 LDN TRADING UPDATE 1/10/25

SP500 LDN TRADING UPDATE 1/10/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~61 POINTS***

WEEKLY BULL BEAR ZONE 6650/60

WEEKLY RANGE RES 6720 SUP 6567

OCT MOPEX 6842/6487

DEC QOPEX 6303/7025

DAILY VWAP BULLISH 6689

WEEKLY VWAP BULLISH 6630

DAILY MARKET CONDITION - BALANCE 6756/6611

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

DAILY BULL BEAR ZONE 6700/10

DAILY RANGE RES 6781 SUP 6666

2 SIGMA RES 6839 SUP 6609

VIX DAILY BULL BEAR ZONE 18.5

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON TEST/REJECT OF WEEKLY BULL BEAR ZONE TARGET DAILY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

### U.S. Equities Color: Q3 in the Books

Date: September 30, 2025

Time: 9:26 PM UTC

#### Market Summary

- S&P 500: +41 bps, closing at 6,688 with a MOC buy imbalance of $5 billion.

- Nasdaq 100 (NDX): +28 bps, closing at 24,679.

- Russell 2000 (R2K): +5 bps, closing at 2,436.

- Dow Jones Industrial Average: +18 bps, closing at 46,397.

- Total Shares Traded: 18.7 billion, compared to the year-to-date daily average of 16.8 billion.

- VIX: +99 bps, at 16.28.

- WTI Crude Oil: -1.7%, priced at $62.37.

- U.S. 10-Year Treasury Yield: +1 bps, at 4.15%.

- Gold: +47 bps, at $3,873.

- DXY Dollar Index: -10 bps, at 97.81.

- Bitcoin: -10 bps, at $114,486.

### Market Dynamics

The market exhibited choppy price action as it closed out the quarter and month-end, amid concerns over a looming U.S. government shutdown at midnight. The most immediate impact of the shutdown is expected to be the cancellation of jobs data scheduled for release on Friday. Essential services like Social Security, Medicare, TSA, air traffic control, and the Federal Reserve are expected to remain operational.

Activity Level: The trading floor rated a 5 on a scale of 1 to 10 in terms of overall activity levels, finishing -31 bps compared to a 30-day average of -15 bps.

### Net Selling and Buying Trends

- Asset Managers: Finished as $3 billion net sellers, primarily due to broad supply across nearly every sector, with a heavy concentration in Healthcare and Technology.

- Hedge Funds: Ended as small net buyers, with notable demand in Healthcare against supply in discretionary sectors.

### Key Themes Observed

1. Weakness in Consumer Finance:

- Companies like SOFI and UPST reported higher charge-offs, raising concerns about the low-income segment. September data appears seasonally related, with financial specialists indicating standard seasonal trends differing from generalist perspectives.

- MCD and WING also highlighted these challenges within the restaurant sector. KMX was noted in auto finance.

2. Strength in Large Pharma:

- Following a press conference by former President Trump, the first MFN deal with PFE (+8%) was confirmed. The outperformance is attributed to the isolation of initially lower prices on marketed drugs to Medicaid, while new drug launches will encompass all payors.

- Increased focus on healthcare policy has been noted, with a DC Healthcare Policy Day event scheduled, featuring panels with industry leaders.

3. Concerns Over Competition from OpenAI:

- Investors are increasingly worried about direct competition from OpenAI, especially following recent product announcements (e.g., agentic commerce, Sora App). This has led to notable weakness in stocks like GOOGL, AMZN, and META.

### Post-Bell Update

- Nike (NKE): Up 2.5% after beating top-line expectations and margins. The stock has traded down 15% from August highs ahead of this report, primarily due to concerns about second-half guidance. The first quarter results were expected to show a small beat, which they did. The focus will now shift to the second-quarter guidance during the 5 PM call.

### Additional Notes

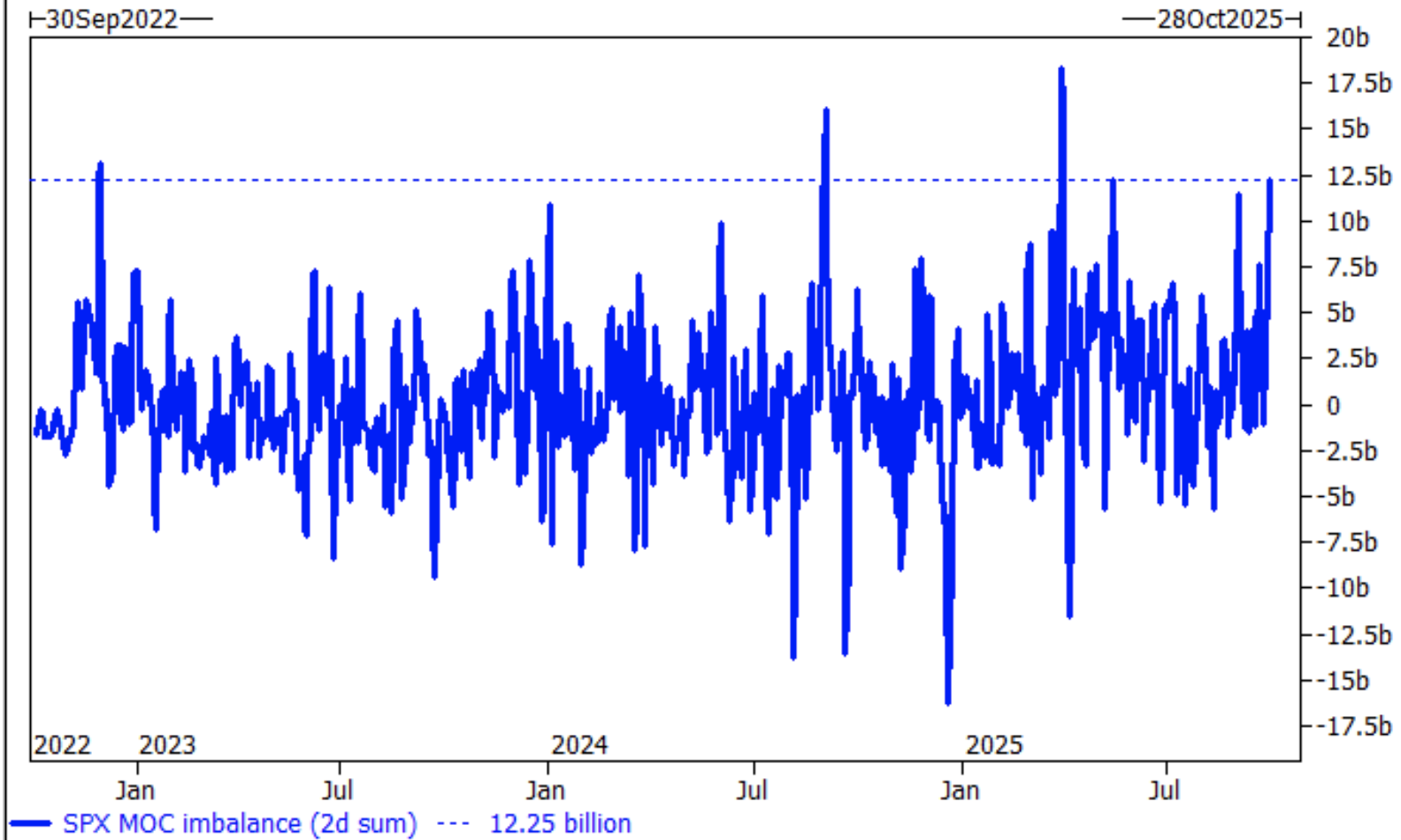

- MOC Buy Imbalance: A significant MOC buy imbalance was observed today, with a combined total of $12.25 billion over the last two days, rivaling previous notable imbalances from November 2022, September 2024, and March 2025.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!