Institutional Insights: UBS FX December Seasonal's In Play

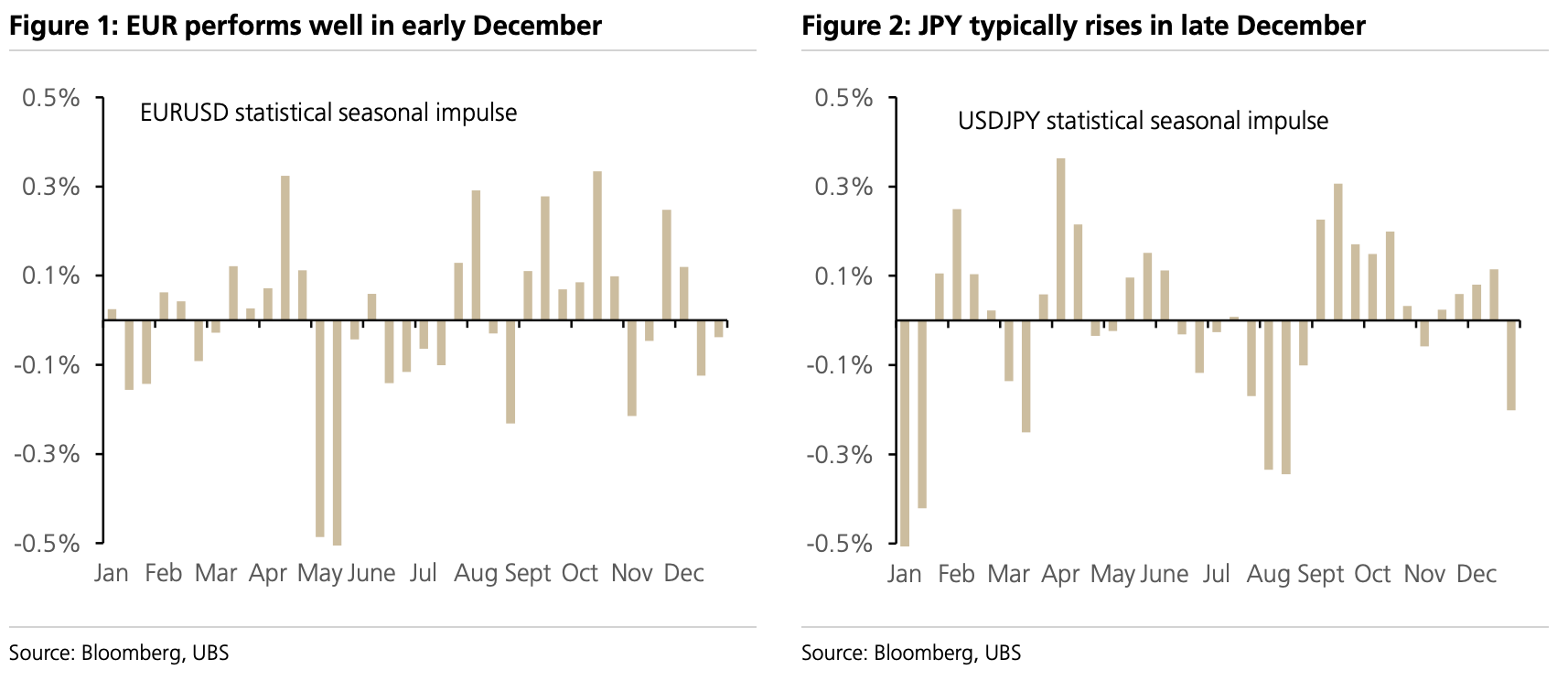

The FX market has entered December with a moderate bias toward USD weakness, aligning with a fairly common seasonal trend: the DXY has weakened in December in 8 of the past 10 years. Notably, the two years with a positive DXY outcome were December following President Trump’s election victories in 2016 and 2024. Our statistical model (refer to p.15) provides a detailed weekly breakdown of seasonal patterns, highlighting EUR, GBP, and NZD as the primary beneficiaries in early December, while CAD typically lags (Figure 1: EUR performs well in early December). Toward the end of the month, JPY usually strengthens, along with SEK (Figure 2: JPY typically rises in late December).

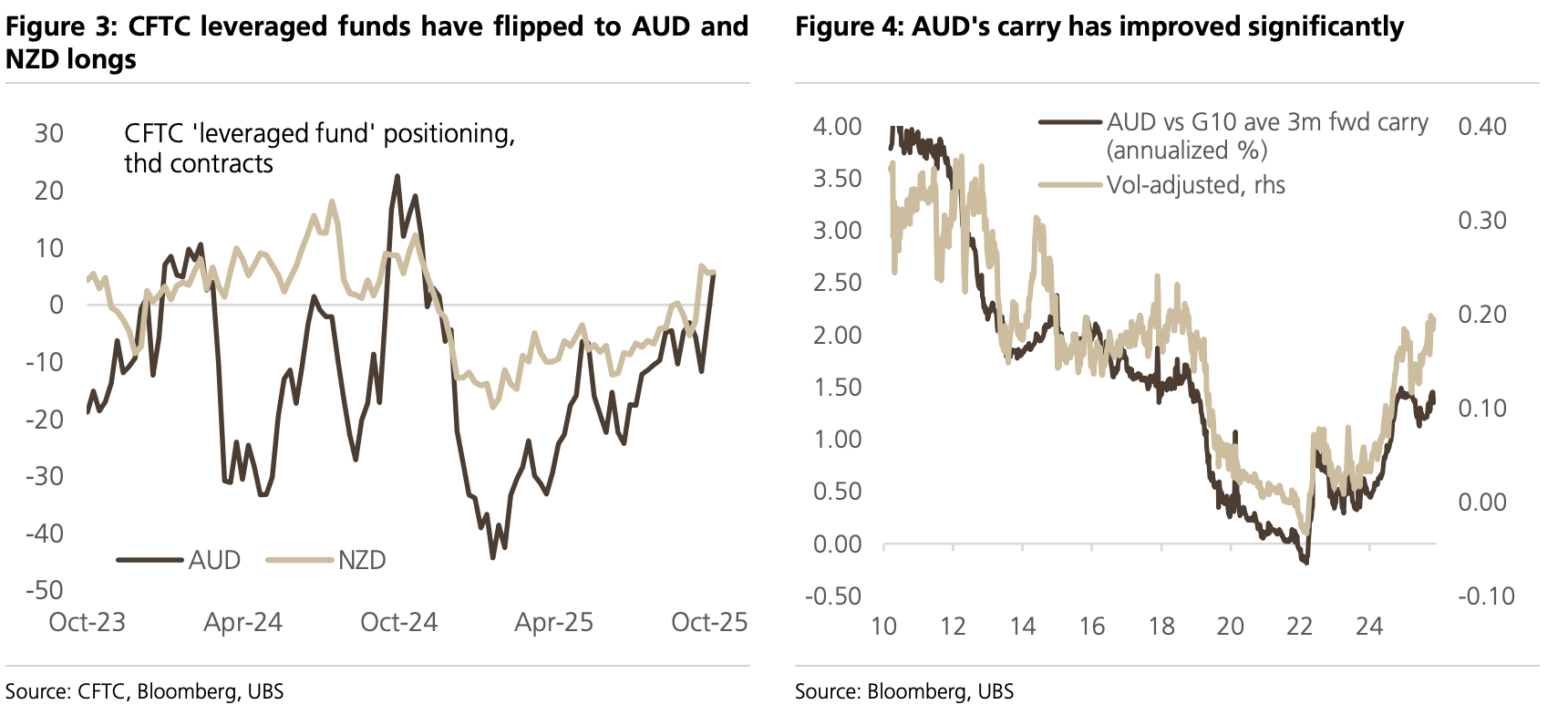

In terms of positioning, visibility remains limited as the CFTC data has only been updated through October 14, and the release schedule suggests a full data update will not occur until mid-January 2026. However, one key observation is the shift from net short to net long positions in AUD and NZD among leveraged funds (Figure 3: CFTC leveraged funds flip to AUD and NZD longs). This marks a significant change, as CFTC fast money accounts have consistently held short positions in these currencies since late November 2024, even during a notable period of USD weakness in the first half of this year. Several factors likely contribute to this shift, including the US-China trade détente and evolving central bank expectations, with both the RBA and RBNZ now anticipated to implement rate hikes in 2026.

Asset managers have continued to maintain short positions in both currencies, with the AUD often serving as a proxy hedge for long equity positions. However, this dynamic may shift next year if the AUD's relative carry continues to strengthen within the G10 currencies, as suggested by current rate expectations. This would increase the cost of holding short AUD positions, with the AUD's average positive carry in the G10 already at its highest level since 2018 in volatility-adjusted terms (Figure 4). Additionally, this improvement could prompt domestic Australian institutional investors, such as Superannuation funds, to raise FX hedge ratios on their foreign asset holdings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!