Institutional Insights: Goldman Sachs Flow of Funds Update 2/12/25

Goldman Sachs flow experts (Gail Hafif, Brian Garrett, Lee Coppersmith) suggest investors focus on top "deals" despite a generally upward trend into year-end.

1. CTAs:

- November: CTAs sold $23B in US equities (~$1.2B/day).

- Projections:

- 1 Week: Flat tape: Buy $15.62B ($5.12B US); Up tape: Buy $19.22B ($4.34B US); Down tape: Sell $14.42B ($1.95B US).

- 1 Month: Flat tape: Buy $37.09B ($12.04B US); Up tape: Buy $61.43B ($14.73B US); Down tape: Sell $142.34B ($51.95B US).

- Pivot level: Watch 6716 for trend reversal.

2. Volatility:

- S&P realized volatility has eased; implied levels remain slightly elevated.

- Systematic volatility-based groups are cautiously re-entering.

3. Systematics:

- VIX dropped from 28 to 16 in a week, marking a significant volatility crush.

- Expect modest demand from systematic investors with limited supply unless disruptions occur.

4. Gamma:

- Dealers are long gamma at current levels, muting market moves on the upside and slightly amplifying downside moves.

- No major downside short gamma risks unless moves exceed 1%.

5. S&P Correlation:

- 1-month implied correlation at 20%, reflecting recent dispersion.

- Active stock picking is key, as themes drive individual winners and losers.

6. Factors:

- Monetary policy and global growth factors are rising due to easing recession fears.

- Low-risk appetite signals opportunities in US$ and Euro-area risk components.

7. Fund Flows:

- Equities dominate (~75% of total assets).

- Positive equity trends expected in 2026, with opportunities in EM and China.

8. Retail:

- Retail buying remains steady despite Bitcoin's decline.

- Dip-buying continues but at a moderated pace compared to earlier highs.

9. Panic Index:

- GS Panic Index fell from 9.6 (Nov 20) to 4.09, indicating reduced fear.

- Watch for volatility-driven changes.

10. Buybacks:

- Corporate buybacks support equities through mid-December, with volumes 1.6x 2024 YTD and 1.8x 2023 YTD averages.

- Support wanes post-12/19 until 2026.

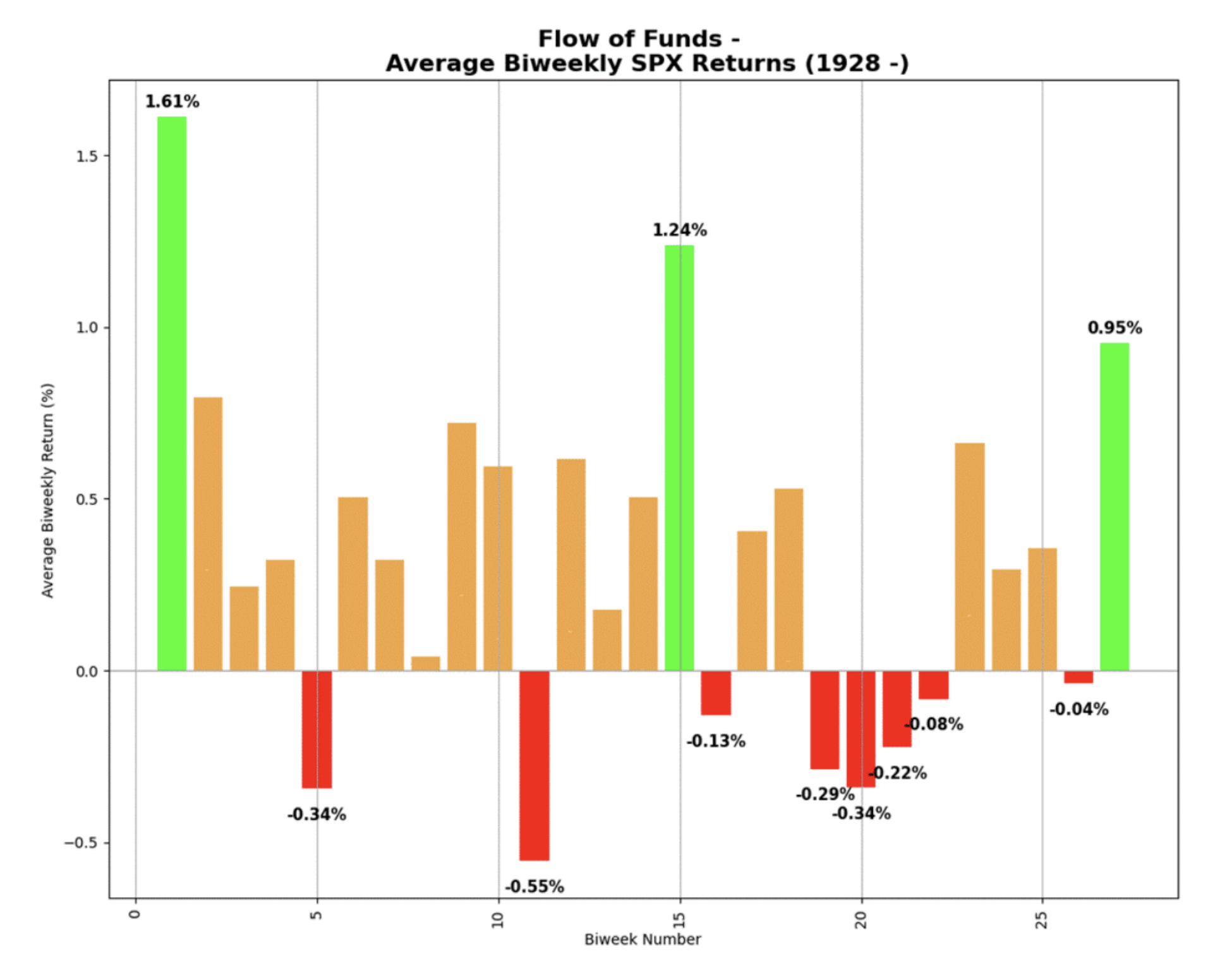

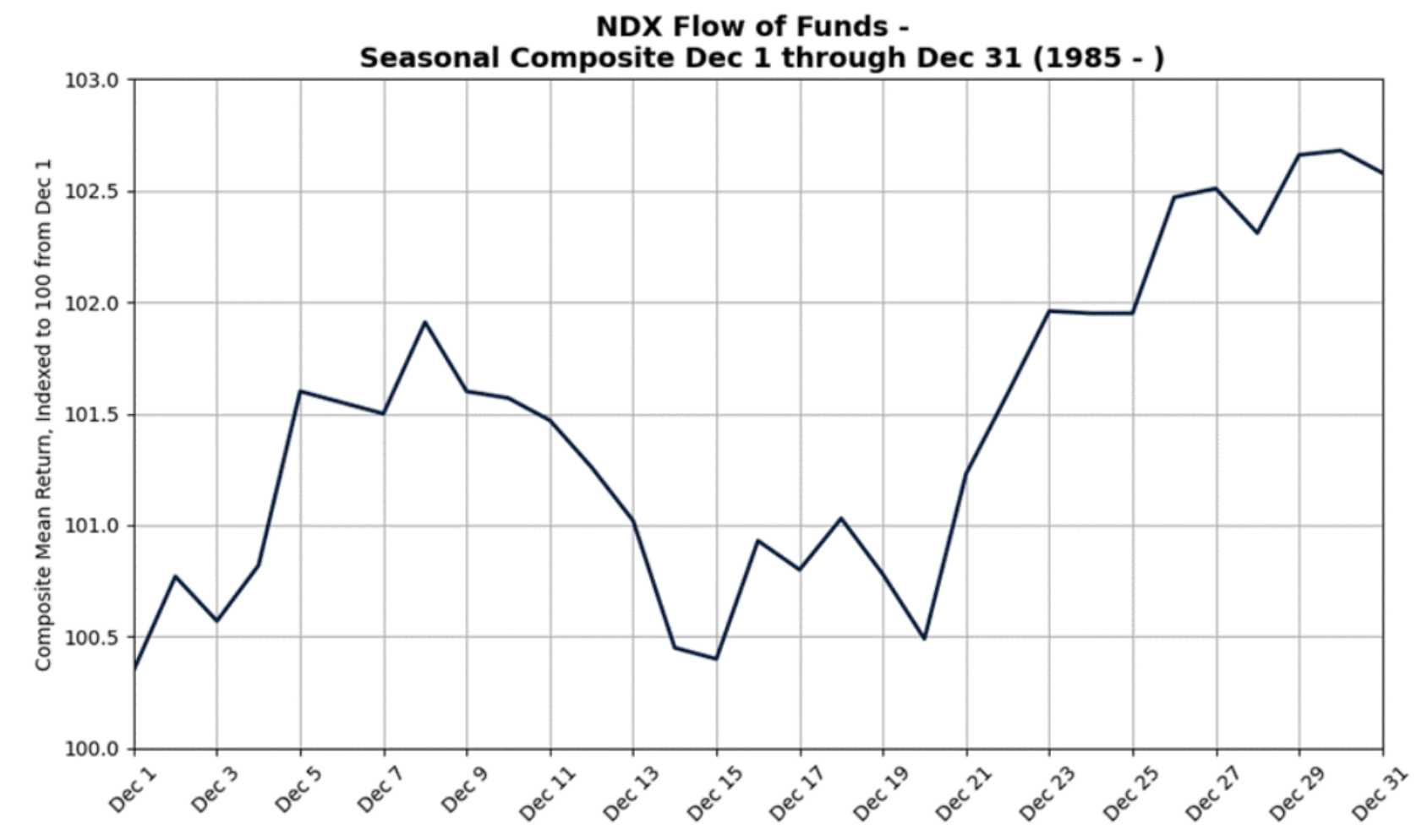

Year-End Trends:

- Early December often choppy for S&P/Nasdaq, but the second half is historically positive.

- Investors should focus on stock-specific action and remain agile.

Trades to Consider:

- SPX Dec 31 6950/7125 Call Spread: Costs $42, max payout 4.2x.

- QQQ Dec 31 635/660 Call Spread: Costs $4.62, max payout 5.3x.

While buybacks and retail activity persist, early December may be volatile before a stronger finish into the holidays.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!