FTSE 100 FINISH LINE 4/12/25

FTSE 100 FINISH LINE 4/12/25

UK's FTSE 100 inched higher on Thursday, rising 0.14% as investors evaluated corporate updates and economic data pointing to potential weaknesses. Burberry shares surged 3.5% after HSBC raised its price target for the luxury goods maker. S&P Global’s latest purchasing managers' index revealed that Britain’s construction activity contracted at its fastest pace since May 2020. The employment index hit its lowest level since August 2020, signalling an uptick in job cuts. Business optimism also fell to its lowest level in nearly three years, alongside a slight increase in cost pressures.

The personal goods sector led market gains, climbing 2.8%. Aerospace and defence stocks extended their rally for the third straight day, driven by stalled Russia-Ukraine peace talks. Rolls-Royce and BAE Systems both rose over 1%. On the other hand, precious metal miners dropped 1.4% as bullion prices declined, with Fresnillo and Endeavour Mining each falling over 1.4%. In other developments, Ofgem, the UK energy regulator, announced a £28 billion investment plan to boost the country’s grid capacity. Despite this, utilities stocks struggled, with SSE dropping 2.1%, while United Utilities, National Grid, and Severn Trent also faced declines.

Among individual stocks, AJ Bell plunged 6.7% after warning of rising costs and challenges to the individual savings account market. Diageo slid 0.8% following a price target cut by UBS, lowering it from £2,250 to £1,850. AstraZeneca fell 0.7%, while Barclays gained 1.2%. Meanwhile, data from Calastone revealed British investors sold £3 billion worth of equities in November, marking the sixth consecutive month of net selling.

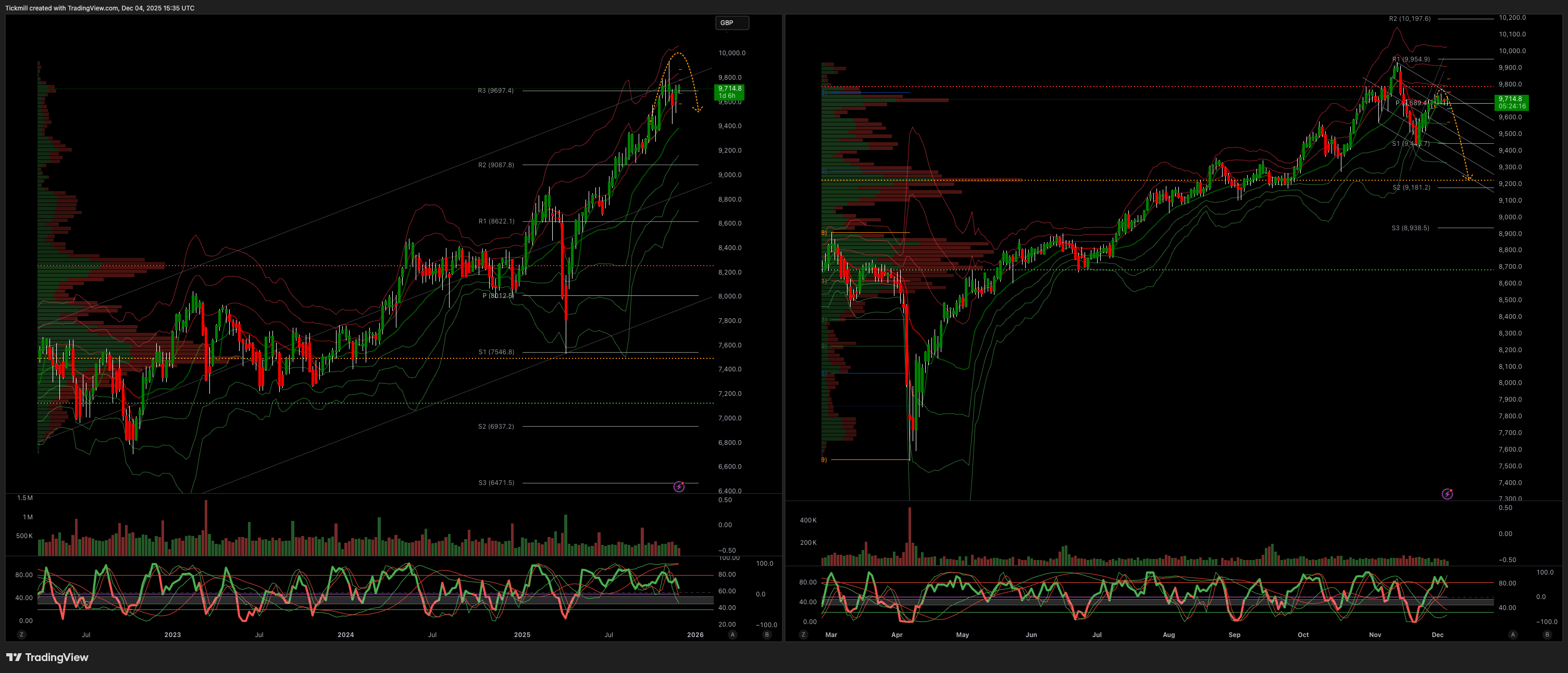

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bearish

Weekly VWAP Bullish

Above 9701 Target 9760

Below 9677 Target 9566

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!