FTSE 100 FINISH LINE 1/12/25

FTSE 100 FINISH LINE 1/12/25

UK midcap stocks faced a setback on Monday, weighed down by declines in the financial and industrial sectors amid a cautious global market sentiment. Investors closely monitored domestic economic data while awaiting further cues on monetary policy direction from the U.S. Federal Reserve. The FTSE 250, which tracks domestic-focused companies, fell by as much as 0.8%, marking its sharpest one-day drop in two weeks. Meanwhile, the blue-chip FTSE 100 remained flat to marginally lower in a volatile trading session. Economic data revealed that Britain's services sector contracted at its fastest pace in three years over the three months to November. However, there was a silver lining in the manufacturing sector, where the PMI rose for the first time since September 2024. Across the Atlantic, investors turned their attention to Federal Reserve Chair Jerome Powell’s upcoming speech, eager for insights into the Fed's policy direction ahead of its next meeting. On the geopolitical front, U.S. and Ukrainian officials held discussions on Sunday about a potential peace agreement with Russia. U.S. Secretary of State Marco Rubio expressed optimism about progress toward ending the three-year conflict.

Aerospace and defence stocks bore the brunt of the downturn, with Rolls-Royce and BAE Systems losing 3% and 2.8%, respectively. Homebuilders also struggled, as shares of Balfour Beatty, Bellway, and Taylor Wimpey all declined by over 1.5%.On a positive note, precious metal miners offered some support, gaining 3.6% as metal prices climbed. Hochschild Mining and Fresnillo led the sector, each surging more than 5%. In corporate news, Melrose Industries saw its shares drop 5.9% after announcing Ross McCluskey as its incoming CFO, effective 2026. Conversely, HICL Infrastructure jumped 4.4% after scrapping its proposed merger with The Renewables Infrastructure Group (TRIG). TRIG shares fell 3.6% following the decision. The merger would have created the UK’s largest listed infrastructure investment firm, with net assets exceeding £5.3 billion ($7.01 billion).

Shares of UK-listed mining companies are experiencing a significant rise as optimism builds around potential U.S. interest rate cuts, which could enhance precious metal prices. Fresnillo is leading the way on the FTSE 100 with an impressive 4.9% surge, followed closely by Antofagasta at 2.6% and Endeavour Mining at 2.4%. Both Glencore and Anglo American have also made notable gains, each advancing by 2.2%, positioning them among the top performers on the blue-chip index. Hochschild Mining has enjoyed a solid increase of 3.8%. Overall, the UK precious metals and mining sector is thriving, with its sub-index nearly tripling in value year-to-date.

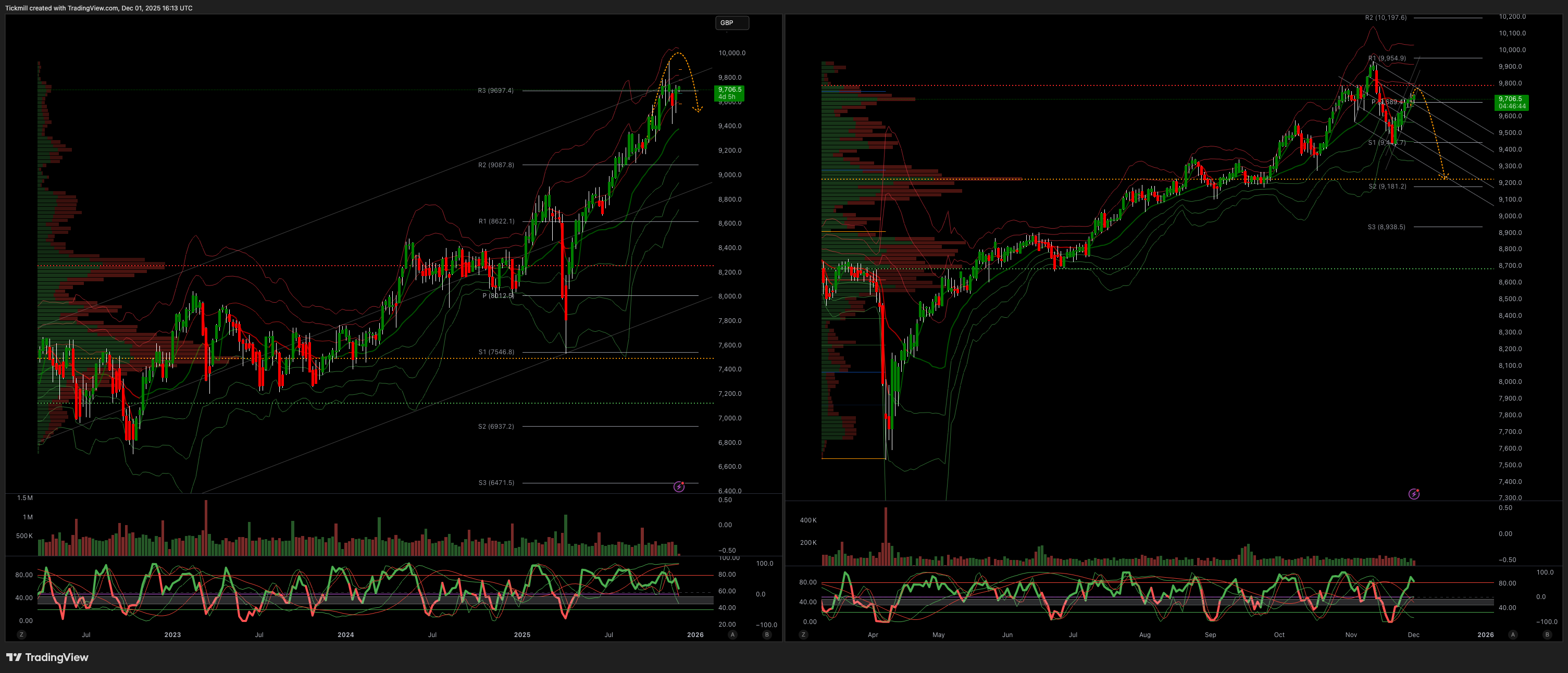

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bullish

Weekly VWAP Bullish

Above 9689 Target 9760

Below 9683 Target 9566

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!