Dollar Slides As US Govt Shutdown Triggered

Shutdown Begins

The US Dollar is turning heavily lower through the middle of the week after Republicans and Democrats failed to agree a funding deal, triggering a US govt shutdown. This marks the first time since 2019 that the administration has failed to secure funding in time and risks around 750k federal employees being furloughed consequently, costing around $400 million a day. The key hurdle to securing a deal was Democrats insistence that any deal should include an extension of expiring Obamacare subsidies which Republicans were staunchly opposed to.

US Jobs Data

With a shutdown now taking effect and no clear view on when its likely to end, there is a huge amount of uncertainty in the US outlook. The upcoming NFP data set on Friday will now be delayed, making it harder for traders to gauge likely Fed action. Today’s ADP release will still go ahead, placing greater importance on that figure for now. As such, any fresh weakness there is likely to fuel heavier USD selling across the end of the week.

Bearish Risks

Traders will now be awaiting updates looking for signs that a deal is forthcoming and the shutdown will end. However, the longe the shutdown holds, the greater the downside impact on the US economy and the deeper the US Dollar is likely to drift near-term. As a result of the shutdown, the October NFP is all but guaranteed to be heavily lower, putting greater pressure on the Fed to ease.

Technical Views

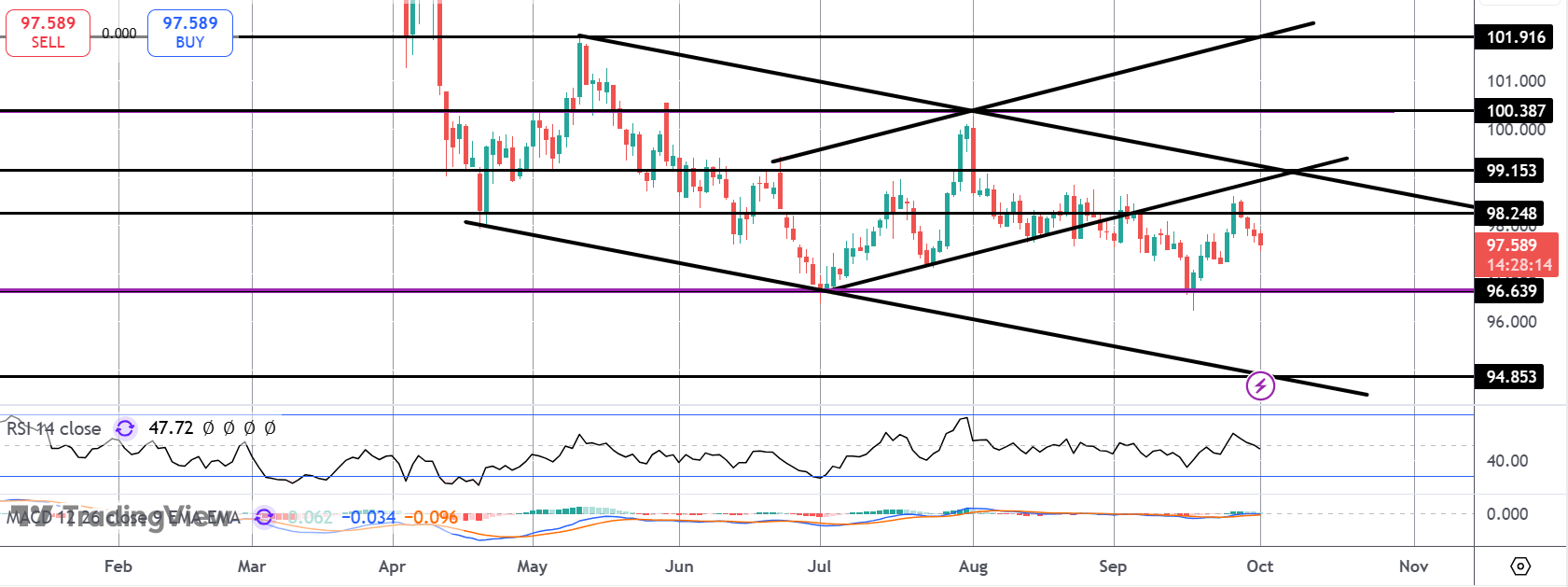

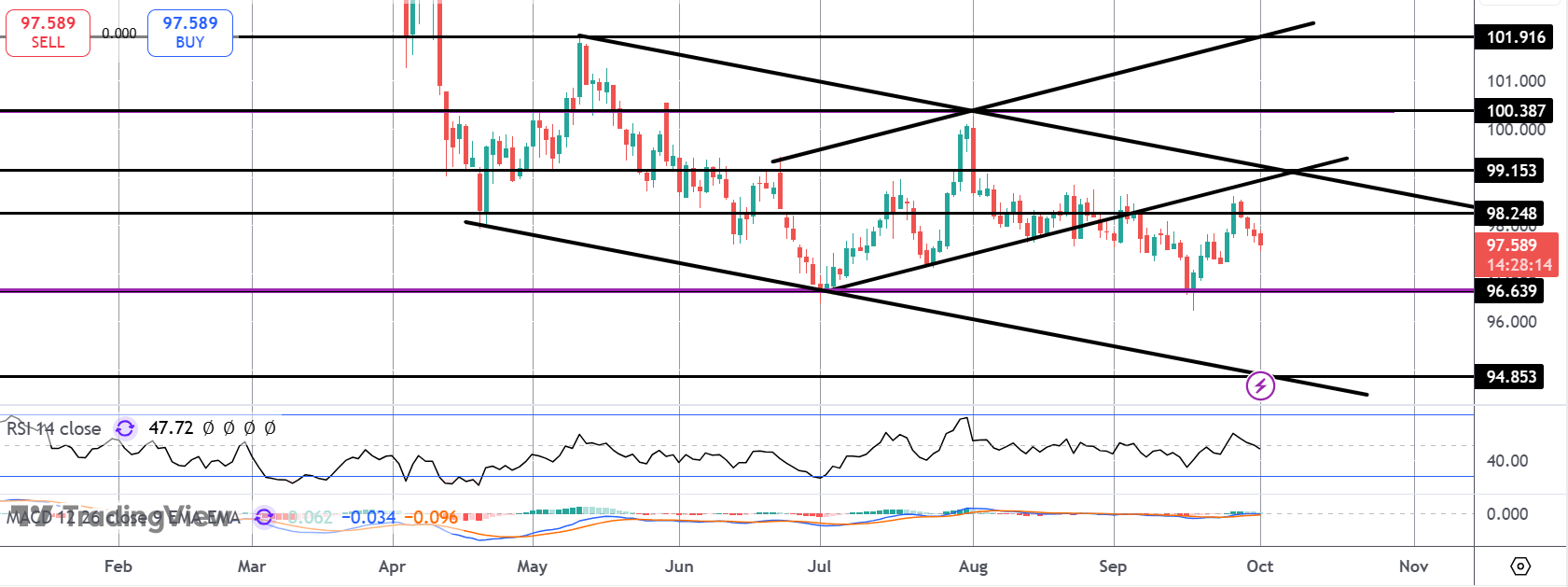

DXY

The index is slipping further from the 98.24 level and risks a fresh test of the 96.63 level near-term. With momentum studies turning lower, focus is on a fresh downside break and continuation towards the 94.85 level and a further test of the bear channel lows.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.