Dollar Sinking Ahead of ADP Release

Dollar Dropping Mid-Week

The US Dollar is turning heavily lower as we move through the middle of the week. Following the failure at the 100.36 resistance late November, DXY is now down challenging the 99.15 support level. The move comes in response to increased speculation that Trump will announce Kevin Hassett as the replacement Fed chair for Jerome Powell. News overnight that Trump cancelled interviews with other candidates has cemented expectations that Powell’s replacement will be Hassett, who is a well-known dove. Indeed, betting markets are pricing an almost 90% chance of Hassett taking the role, up from around 35% pre-Thanksgiving.

Fed Easing Forecasts

USD is also tumbling as Fed easing expectations weigh on sentiment in the approach to the December FOMC. The market is currently pricing an 87% chance of a cut this month. Looking ahead today, focus will be on the ADP jobs number. Given that the October and November NFP sets will be delayed until after the FOMC this month, today’s data will take on a high-level importance as the key labour market gauge ahead of the Fed meeting. If data drops as expected (7k forecasted vs 42k prior), this should cement December easing forecasts, leading USD firmly lower. A downside surprise would be the most bearish scenario for USD today. If, however, we see an upside surprise today this could see USD bouncing back as traders scale back easing forecasts.

Technical Views

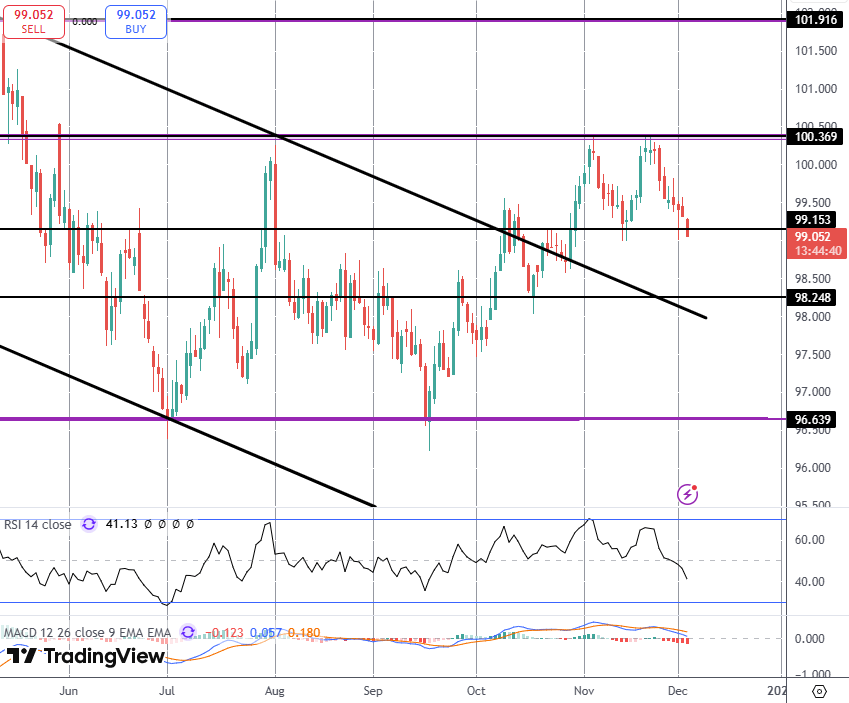

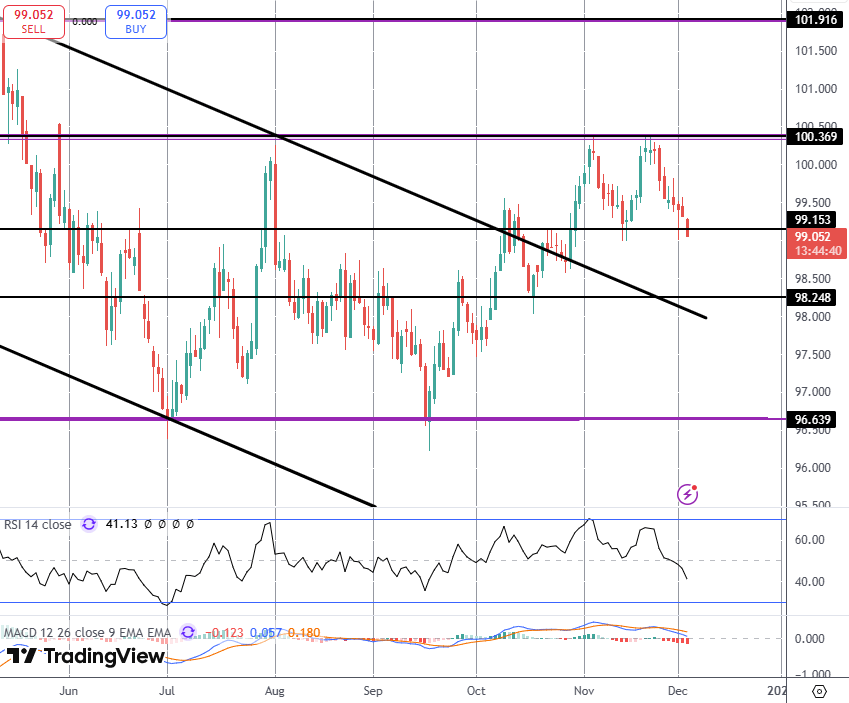

DXY

The failure at the 100.36 level has seen DXY reversing heavily lower with price now probing support at the 99.15 level. With momentum studies dropping sharply, risks of a deeper push towards the 98.24 level are seen with a retest of the broken bear channel in that region also.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.