Copper Rally Continues on Supply Issues

Copper Pushing Higher

Copper prices have regained bullish momentum this week following a strong up move yesterday. The futures market is now back at 2-month highs as the recovery move off the August lows continues to gain ground. The market has now recouped around 40% off the loss from YTD highs seen in the summer as prices collapsed in the absence of an anticipated 50% tariff on copper.

Copper & Trump

The move, threatened by Trump in early summer, was expected to be part of the sweeping tariff announcements in August. However, copper was widely spared with only some specific areas of the market seeing tariffs. Since then, bearish momentum was seen reversing with prices now grinding higher as attention moves back towards supply issues, global demand and US Dollar expectations.

Mine Closures

The closure of key mine in Indonesia this week, accounting for around 3% of global supply, has helped underpin prices. Owner of the mine, Freeport McMoRan, warned that the site might not be active again until 2027. This comes one the back of a string of issues in Southern American mines this year, reminding traders of how vulnerable the market is to these types of incidents.

US Jobs Data

Looking ahead, there is room for copper prices to continue higher near-term if USD starts to push lower as we approach the October FOMC. The Fed is widely expected to cut rates again with the upcoming US jobs report on Friday set to be a key signpost for the meeting. As such, any weakness in Friday’s data should weigh on USD allowing copper to continue higher.

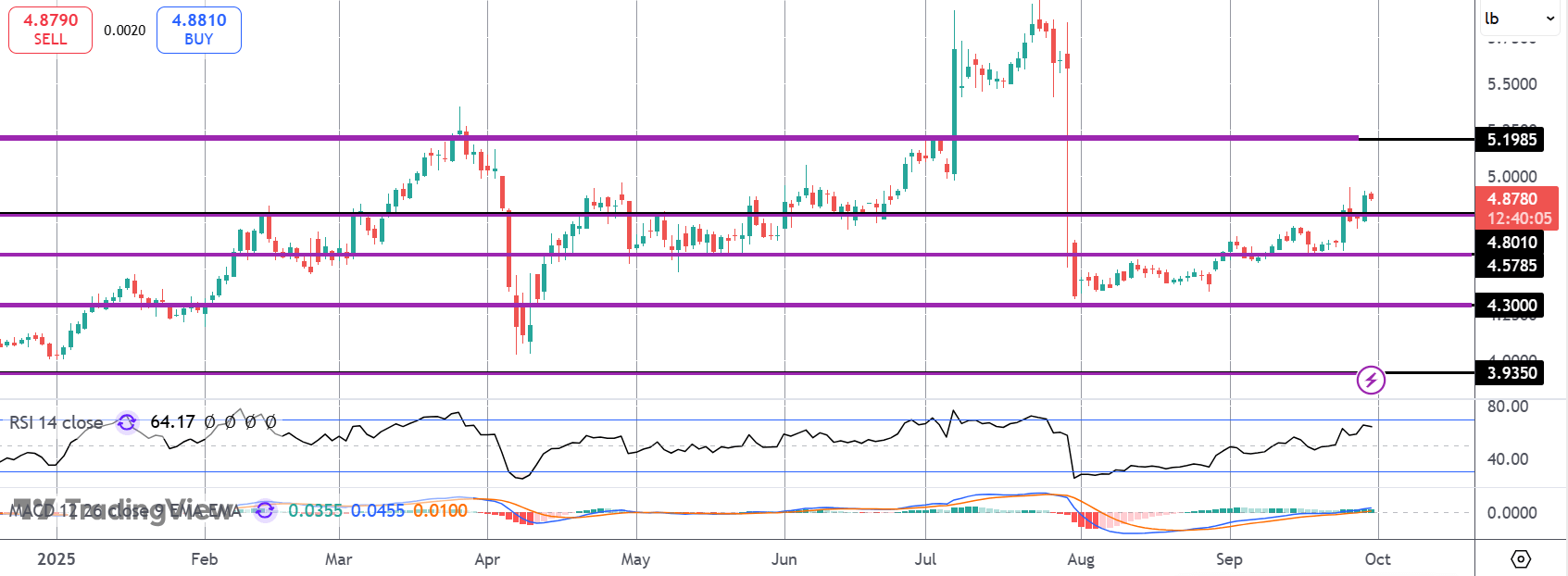

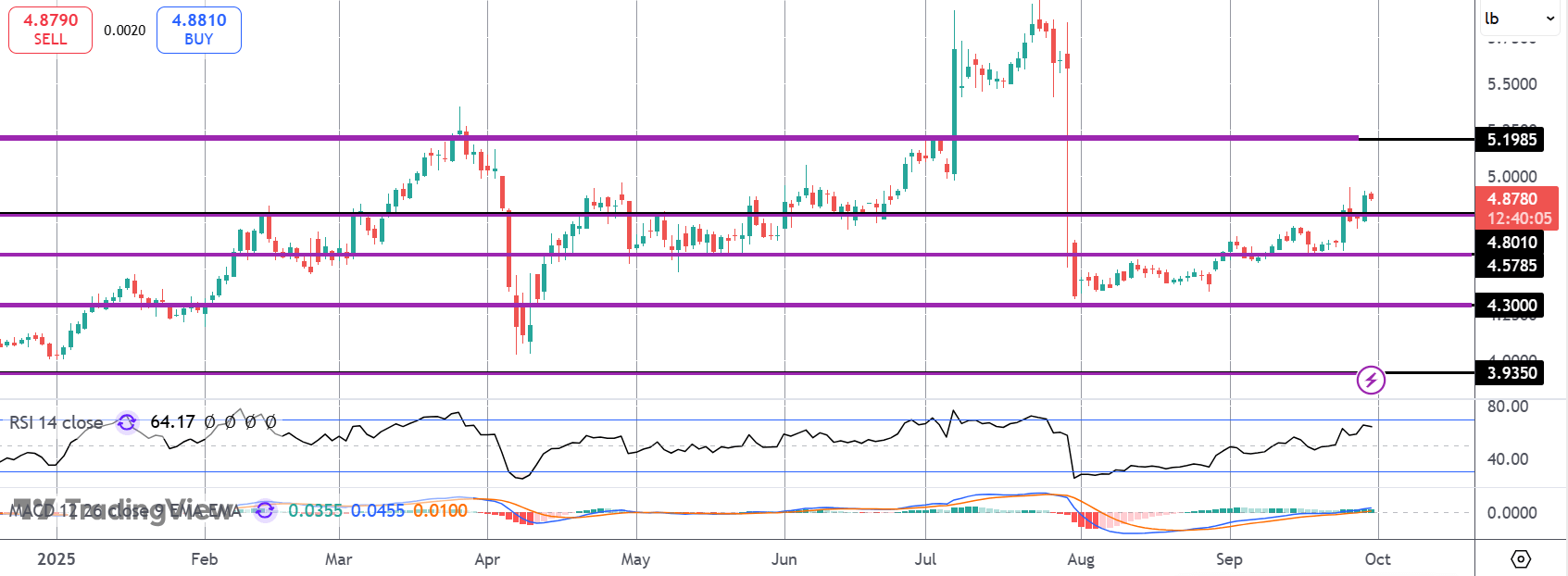

Technical Views

Copper

The rally in copper has seen the market moving back above the 4.8010 level. With momentum studies bullish, focus is on a continuation back to the 5.1985 level next ahead of the YTD highs above. This outlook only shifts on a break back below the 4.5785 level near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.