Bullish Channel Break In Bitcoin

BTC Breaking Out

The sell off in USD as a result of a US government shutdown being triggered this week looks to be playing nicely into the hands of BTC bulls here. Stocks have remained higher against the backdrop of today’s news with the general read being that the shutdown will simply increase the pressure on the Fed to ease. Indeed, market pricing for rate cuts this month and in December have risen today reflecting these increased dovish expectations. With risk assets set to benefit accordingly, BTC is pushing higher today, suggesting room for a higher push into the weekend. Friday’s headline US NFP data will now be delayed as a result of the shutdown and with no visibility yet on how long the shutdown will last, USD is at risk of a deeper move near-term, turning the outlook more bullish for BTC.

US Data Today

Looking ahead, traders should watching ETF inflows for a clue as to how BTC is likely to develop near-term. Monday saw a sharp uptick in BTC ETF inflows preceding this move suggesting the current rally is set to continue near-term. Focus will now be on today’s incoming US data. If we see any fresh weakness this should amplify USD selling pushing BTC higher through the end of the week.

Technical Views

BTC

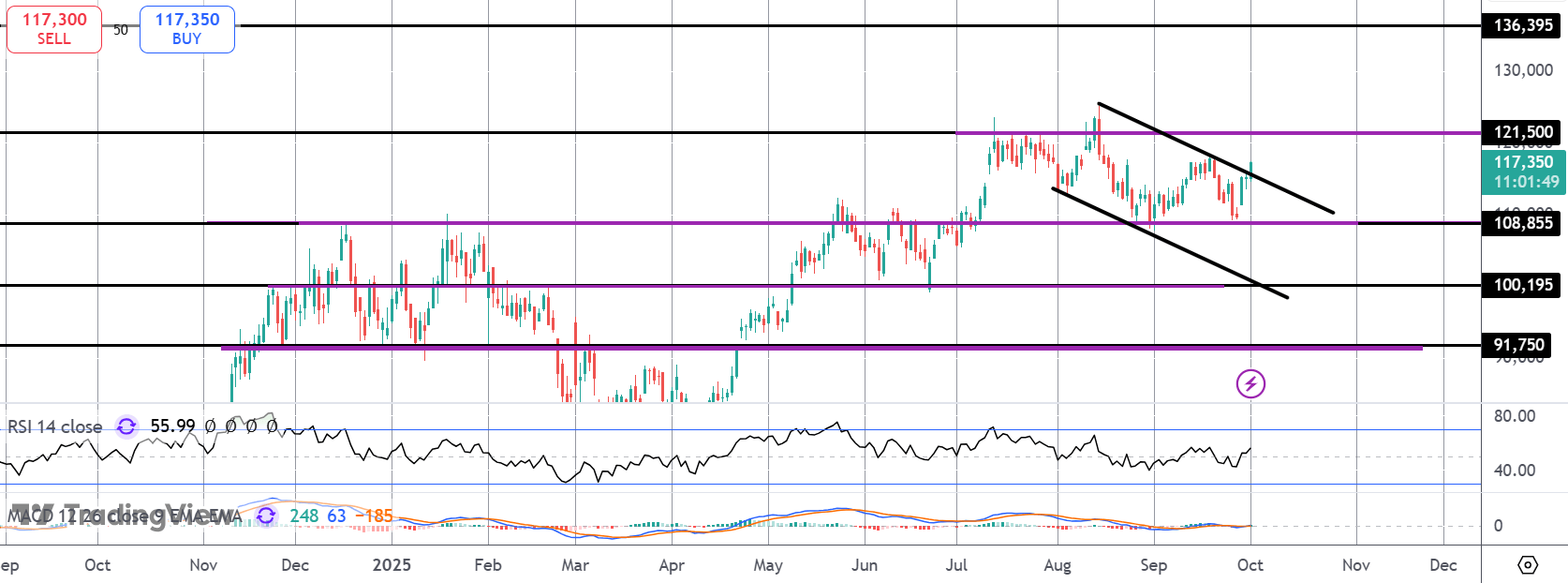

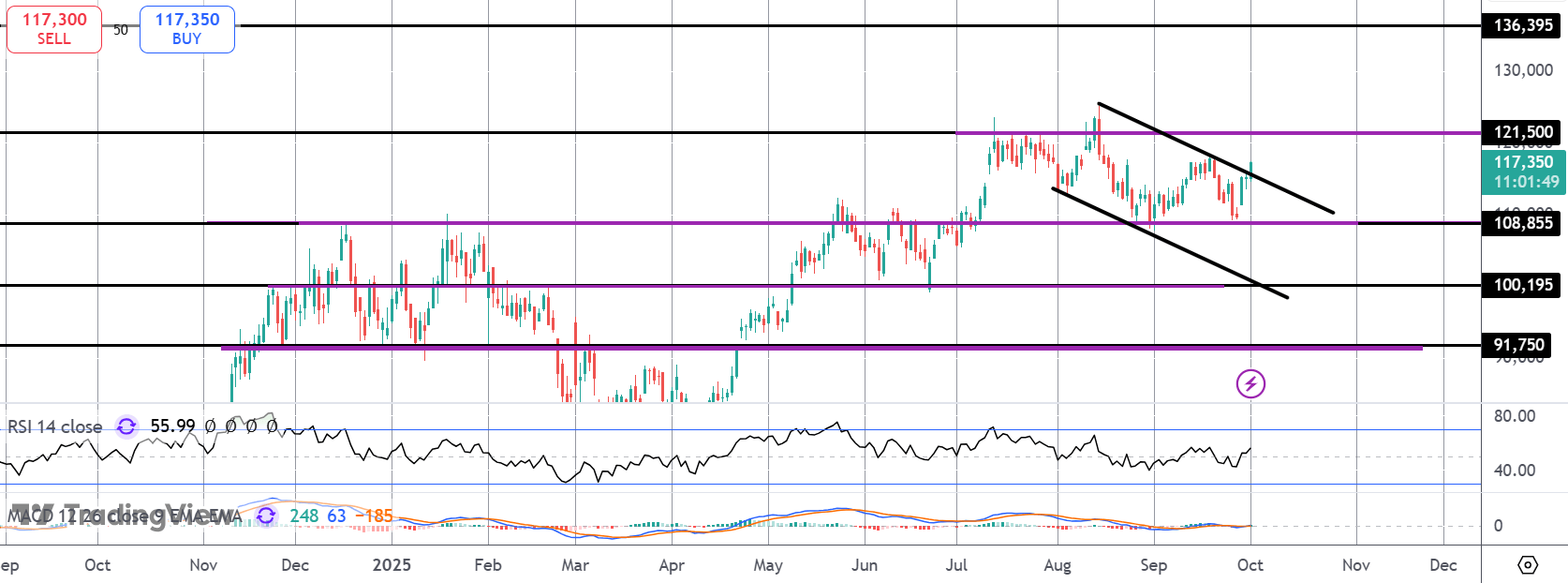

The rally off the $108,855 level has seen BTC breaking above the bear channel highs. Price is now fast approaching a test of the $121,500 level and with momentum studies turning higher, focus is on a fresh breakout higher with $136,395 the higher target for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.