BOJ/FED Divergence Weighs on USDJPY

USDJPY Down From Highs

USDJPY is on course to end the week mildly in negative territory with the pair having pulled back from the 158 highs printed last week. A dovish repricing in the Fed rates outlook is the key driver behind the move. Pricing for a December rate cut has jumped to around 85% currently from sub-40% at the start of last week. The move comes on the back of the mixed September labour market reports we saw last week, followed by some dovish commentary from Fed’s Williams. This week, weaker-than-forecast US retail sales and PPI data added to this dovish pressure with traders now widely expecting a rate cut at the upcoming FOMC meeting.

BOJ/Fed Divergence

On the Yen side, traders remain fearful of intervention from Japanese authorities as price nears. Indeed, Reuters ran a story this week citing sources disclosing that the BOJ was readying for a rate hike next month. With clear divergence now between traders’ Fed and BOJ expectations, USDJPY looks vulnerable to further downside near-term, particularly if we see any more US data weakness ahead of the FOMC. Looking ahead, Morgan Stanley forecasts that the Yen could rise by as much as 10% against USD in coming months based on US rate cut expectations alone. If the NOJ does hike, this should amplify the dynamic.

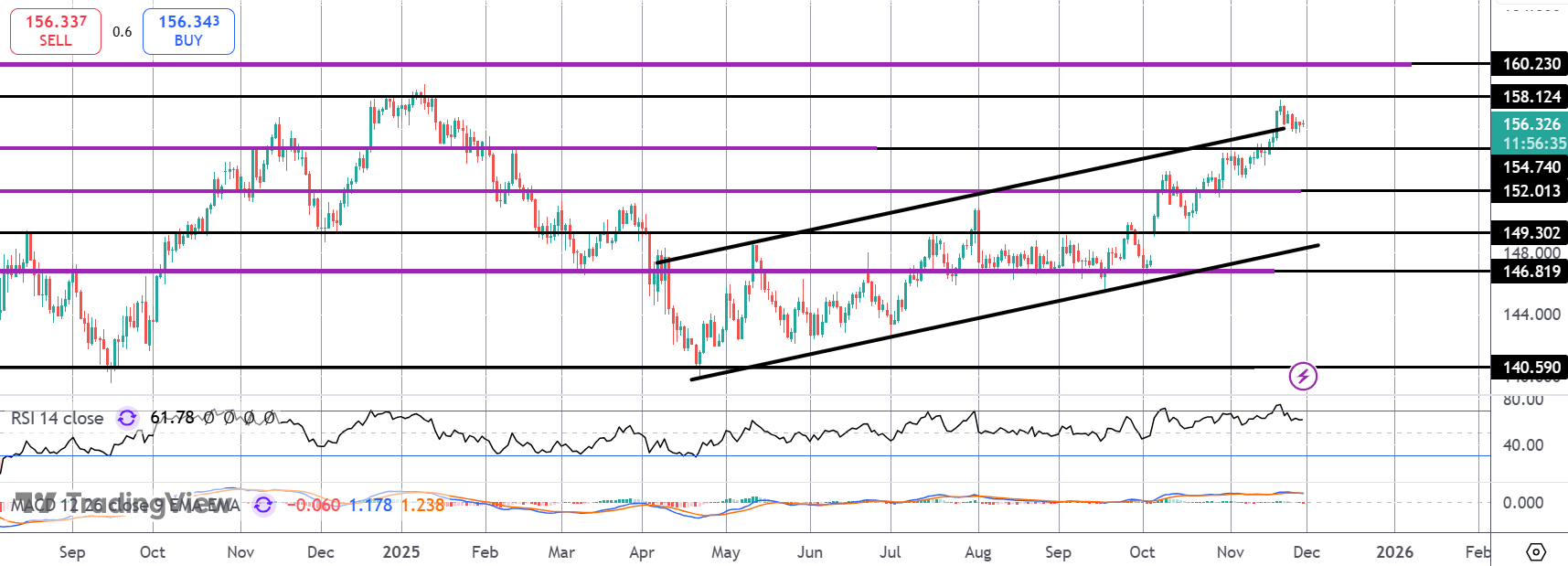

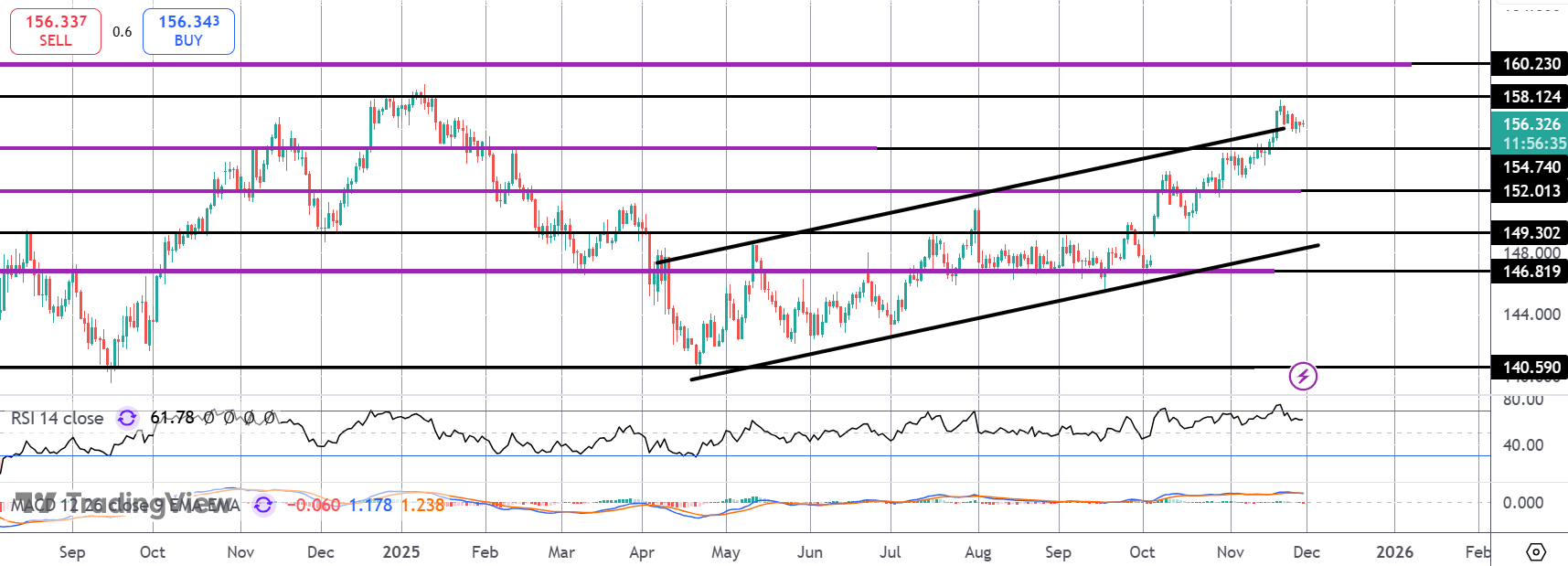

Technical Views

USDJPY

The rally in USDJPY has stalled for now into a test of the 158.12 resistance. Price is now drifting back down towards 154.74 support, currently retesting the broken bull channel highs. While this area holds as support, further upside is still in focus. Below 154.74, however, focus shifts to 152 as the deeper level to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.